The daily price action formed bull candle with higher high higher low indicating continuation of uptrend - ICICI Direct

Nifty :25002

Technical Outlook

Day that was…

Indian equity benchmarks opened a positive note tracking mixed global cues.. Nifty settled the day at 25002, up 0.6%. Broader market relatively outperformed as Midcap &Smallcap Index gained 0.8% and 0.37%. Meanwhile, Nifty Auto,defense,IT,Metals & FMCG were major gainer with for the day

Technical Outlook

• The daily price action formed bull candle with higher high higher low indicating continuation of uptrend . Post positive opening index remained sideways in range 24900-25100 throughout the day and near 25000 mark

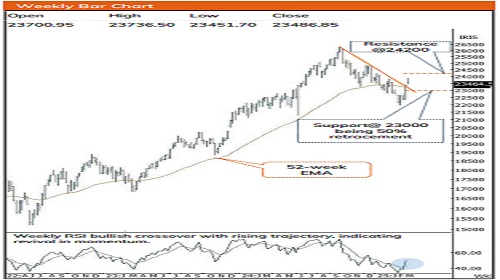

• In the upcoming week, we expect volatility to remain elevated due to monthly expiry. The index is undergoing a healthy retracement after witnessing sharp up move over last week. The elongation of rallies followed by shallow retracement clearly highlights robust price structure that makes us maintain our positive stance and expect Nifty to head towards 25500 in coming months. Going forward in the near-term we expect market to form strong base formation (24200-25100) which would make the market more healthy and open the next leg of upside in the coming month

• For the coming week, strong support is placed at 24200-24400 zone. Meanwhile, on the upside, 25100 would continue to act as immediate resistance

• As far as broader market is concern both Nifty Midcap and Small cap Index are resuming uptrend after consolidating above its April breakout area and witnessed shallow retracement indicating inherent strength. Going forward We expect catch up activity in both the Indices in the coming month as currently both the Indices are 7% and 11% away from its All-time high. Historically, maximum average correction in Midcap and small cap indices have been to the tune of 27% and 29% while time wise such correction lasted for 7-8 months. Subsequently, both indices have seen 32% and 28% returns, respectively in next six months

• Market breadth is always a good indicator to understand the sentiment of the market In the current context Currently 86% stocks of Nifty 500 universe are now trading above their 50-DMA and 39% above their 200-DMA compared to April month’s lowest reading of 27 and 15 respectively, clearly indicating pick up in broader market participation. Key point to highlight is that the current up move is backed by the broad based participation, indicating the current upmove is secular in nature. that has been further validated by significant improvement in momentum, breadth as well as sentiment indicators Key monitorable which would act as tailwind

a. The US Dollar index is on the verge of breakdown from two years low of 99.50

b. Weakness in Brent crude oil persists at higher levels , currently hovering around 6

c. Bilateral Trade Agreement between India and US

Nifty Bank : 55572

Technical Outlook

Day that was :

The Bank Nifty, started the week on a positive note . The index settled at 55572 , up 0 .31 % . The Nifty PSU Bank index mirroring the benchmark closed on a positive note and settled at 6714 , up 0 .17 % .

Technical Outlook :

• The index started on a week on a positive note and then inched northwards seen positive follow up to Fridays bull candle . The daily price action formed a High wave like candle with upper and lower wick, signaling elevated buying demand from 20 -day EMA .

• Bank nifty has been sailing through the global volatility ,as Over last four weeks Index has been consolidating in a broad range (56098 -53480 ) after sharp rally of 14 % in month of April suggesting healthy retracement . However index managed to hold last week low forming a higher base, that bodes well for next leg of up move towards 57000 in the coming months, as it is the external retracement of the fall from 56 ,098 –53 ,483 , or consolidation in the range(56098 -53480 ) would continue . Meanwhile, strong support is placed at 54 ,000 , which is the 80 % retracement of the recent up -move (53 ,483 –55 ,499 ) and coincides with the gap area witnessed on 12th May (54 ,055 –54 ,442 ) . Hence, any decline from hereon would lead to higher base formation, setting the stage for the next leg of the upmove .

• Structurally, the Bank Nifty is witnessing elongation of rallies followed by shallow retracements, which signifies a robust price structure . The recent up -move of 14 % is larger compared to the previous month’s 9 % rise . Additionally, the declines are getting shallower, with the recent one being 4 . 6 % versus 5 . 6 % in March 2025 . Furthermore, the index broke out of an eight -month falling trendline and surpassed its lifetime high, highlighting a robust structure .

• However, the Nifty Private Bank index underperformed the benchmark . PSU Banks are place at favourable risk reward setup and we expect catch up activity in this space . The index rebounded from the vicinity of 20 -day EMA and 50 % retracement of the move from (26742 -27796 ) and closed flat for the day, indicating buying demand at lower levels . Further, index need to close decisively above 27800 level which will open the gate towards the recent swing high of 28 ,050 . Meanwhile, immediate support on the downside is placed at 26 ,700 , being the 38 .20 % retracement of the recent up -move (24 ,400 –28 ,050 )

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Quote on Market Wrap by Shrikant Chouhan, Head Equity Research, Kotak Securities