The Bank Nifty, past three session of upmove closed the session on a negative note despite firm global cues - ICICI Direct

Nifty :24684

Technical Outlook

Day that was…

Indian equity benchmarks ended the session on a negative note despite firm global cues. The Nifty settled at 24,684, down 1.05%. Market breadth was in favor of declines, with an A/D ratio of 1:2, as the broader market underperformed. Sectorally, all indices ended in red, where Auto, Health Care, and FMCG were the laggards.

Technical Outlook:

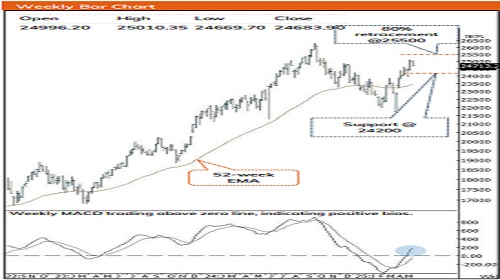

* The index opened flat to positive note. However, profit booking at higher levels resulted into southward momentum as intraday pullbacks were short lived. As a result, daily price action formed a bearish candle carrying lower high-low, indicating extended correction after last week’s 4% up move.

* The index is undergoing a healthy retracement after witnessing sharp up move over last week. However, the elongation of rallies followed by shallow retracement clearly highlights robust price structure that makes us maintain our positive stance and expect Nifty to head towards 25500 in coming months. Hence, any decline from hereon should be used as buying opportunity as strong support is placed at 24,200. In the process, bouts of volatility will prevail amid end of earnings season. Hence stock specific action is likely to continue.

* On the broader market front, the Nifty Midcap and Small Cap indices witnessed profit booking after a sharp rally last week. However, such declines after elongation of rallies are accompanied by shallow retracement indicating breather. Furthermore, the strong recovery from march lows formed a durable bottom which has approached maturity in price and time-wise correction. On the expectation of catch-up activity, the broader market is likely to outperform the benchmark, as currently Nifty is just 5% away from its all-time high, while Midcap and Small Cap indices are 7% and 12% away, respectively. Historically, the maximum average correction in Midcap and Small Cap indices has been to the tune of 27% and 29%, while time-wise such corrections lasted for 7–8 months. Subsequently, both indices have seen 32% and 28% returns, respectively, in the next six months.

* Our positive view is further validated by the following observations:

* a) Past three decades trend suggest, FII’s selling of Rs. >30000 cr. during any quarter, the subsequent 12 months Nifty returns have averaged around 28%. In most cases FII’s returned back leading to subsequent market rally.

* b) US-China trade deal has eased the recession worries in U.S. that in turn bodes well for future rate cuts.

* c) Risk on sentiment kicks in tracking tariff development coupled with cool off in US 10-year bond yield, crude oil prices, and weak U.S. dollar.

* d) Currently 85% stocks of Nifty 500 universe are now trading above their 50- DMA and 41% above their 200-DMA compared to April month’s lowest reading of 27 and 15 respectively, clearly indicating pick up in broader market participation.

* The breakout from three weeks consolidation confirms resumption of uptrend that makes us revise support base at 24200 as it is 80% retracement of recent rally (23935-25116) and coincides with the gap area witnessed on 12th May (24,164–24,378).

Nifty Bank : 54877

Technical Outlook

Day that was :

The Bank Nifty, past three session of upmove closed the session on a negative note despite firm global cues . The index settled at 54 ,877 , down 0 .98 % . The Nifty PSU Bank index mirroring the benchmark closed on a negative note and settled at 6 ,662 .55 , down by 0 .93 % .

Technical Outlook :

* The index commenced the week on a positive note . After the initial gains, it faced resistance near the previous week’s high but still managed to close on a positive note . The daily price action formed a small bullish candle with an upper wick, signaling a breather .

* Going ahead, we expect index to decisively close above the previous two weeks’ high, which would signal resumption of the upmove and open the door towards the 57 ,000 mark, as it is the external retracement of the fall from 56 ,098 –53 ,483 . Meanwhile, strong support is placed at 54 ,000 , which is the 80 % retracement of the recent up -move (53 ,483 –55 ,499 ) and coincides with the gap area witnessed on 12th May (54 ,055 – 54 ,442 ) . Hence, any decline from hereon would lead to higher base formation, setting the stage for the next leg of the upmove .

* Structurally, the Bank Nifty is witnessing elongation of rallies followed by shallow retracements, which signifies a robust price structure . The recent up -move of 14 % is larger compared to the previous month’s 9 % rise . Additionally, the declines are getting shallower, with the recent one being 4 . 6 % versus 5 . 6 % in March 2025 . Furthermore, the index broke out of an eight - month falling trendline and surpassed its lifetime high, highlighting a robust structure .

* However, the Nifty Private Bank index underperformed the benchmark but closed flat for the day, indicating a breather after the previous week’s 3 % up -move . The underlying price structure, emerging from a three -week consolidation phase resembling a bullish flag, remains firmly intact . A breakout from the aforementioned pattern will likely lead the index to gradually progress towards the recent swing high of 28 ,050 . Meanwhile, immediate support on the downside is placed at 26 ,700 , being the 38 .20 % retracement of the recent up -move (24 ,400 –28 ,050 ) .

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

.jpg)