Technical Morning Ideas : BankNifty Opens Gap-Up, Faces Resistance Near 51230, Ends at 51000 by Vaishali Parekh, Prabhudas Lilladher Pvt Ltd

Forecast

NIFTY / SENSEX

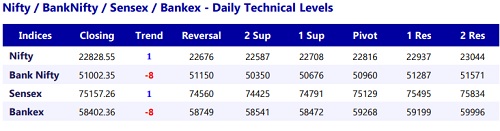

Nifty, witnessed a strong move to close above the 22800 zone almost to fill up the gap, and once again moving out of the descending channel pattern improving the bias and sentiment anticipating for further rise in the coming sessions. The index would have the near-term important hurdle near the 50EMA level at 23000 zone which needs to be breached decisively which can further establish conviction for upward move in the coming days. Sensex, has indicated a decent rise last week having the important 50EMA zone of 75900 level as the immediate target and with the bias improving, one can anticipate for the next target of the 200 period zone at 79000 level in the coming days with nearterm support maintained near the 73400 zone as of now. . The support for the day is seen at 22700 levels while the resistance is seen at 23100 levels.

BANKNIFTY / BANKEX

BankNifty, after opening with a gap up carried on with the positive move till 51230 zone where it witnessed resistance and with some profit book seen ended the session near the important 200 period MA at 51000 level with bias and sentiment improved. Further ahead, a decisive breach above the 52000 zone shall confirm a breakout anticipating for fresh upward move in the coming days. Bankex witnessed a significant recovery last week moving past the important 200 period MA at 58120 level to strengthen the trend and we can expect further rise. With the bias and sentiment getting better, we can expect an upward move till initial target of 60000 zone in the coming sessions. The 50EMA level of 57300 zone would be the near term support level as of now. BankNifty would have the daily range of 50500-51700 levels.

Above views are of the author and not of the website kindly read disclaimer