Technical Forecast : Nifty extends gains; bias remains optimistic by Vaishali Parekh, Vice President – Technical research, PL Capital

Market Preview

Nifty extends gains; bias remains optimistic

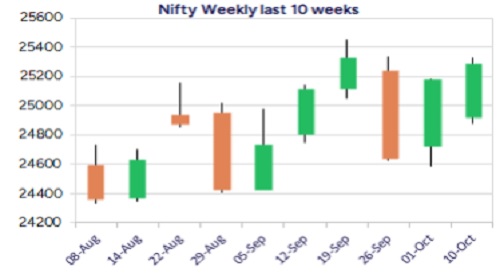

Nifty gained further closing near the 25300 zone with the broader markets also showing active participation to support the benchmark index and can anticipate for furhter rise in the coming days. Bank Nifty witnessed a decent postive move to close above the 56600 zone with bias getting better anticipating for further upward move in the coming days. The market breadth was strong with the advance decline indicating a ratio of 2:1 at close

Market Forecast

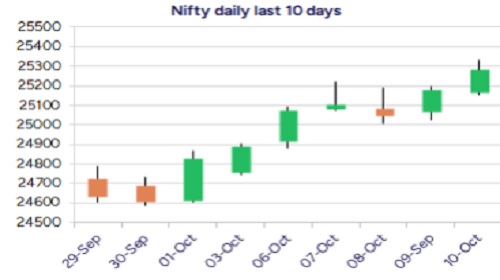

Nifty daily range 25150-25500

Nifty has continued with the positive move gaining further crossing the 25300 zone during the intraday with bias and sentiment improving once again with the broader markets showing signs of positive move anticipating for further rise in the coming days. The index would need a decisive close above the important hurdle at 25300 zone to establish conviction and thereafter, can expect for fresh upward move with 25700 level as the next immediate target

BarikNifty, has shown signs of gaining strength further to move past the 56600 zone with bias improving and the frontline banking stocks picking up well with further upside gain visible in the coming days. With the 55600 level positioned as the near tem support for the index, we can anticipate for further upward move for target of 57700 zone in the coming days with sentiment easing out and maintaining an optimistic approach with the ongoing festive season.

The support for the day is seen at 25150 levels, while the resistance is seen at 25500 levels. BankNifty would have the daily range of 56200-57300 levels.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

More News

Quote on Pre-Market Comment by Mandar Bhojane, Research Analyst, Choice Broking Ltd