Stocks in News & Key Economic Updates 12th Feb 2026 by GEPL Capital Ltd

Stocks in News

* KERNEX MICROSYSTEM: The company has secured a Rs. 411 crore order from Banaras Locomotive Works for the supply of 505 Kavach locomotive equipment.

* SARDA ENERGY: The company has received approval from the Chhattisgarh Environment Conservation Board to expand the Gare Palma Coal Mine capacity from 1.68 MTPA to 1.8 MTPA,

* HINDALCO INDUSTRIES: The company has disclosed that the Novelis fire incident is expected to have a total free cash flow impact of approximately $1.3–1.6 billion.

* TALBROS AUTOMOTIVE: The company announced a leadership reshuffle with Chairman Naresh Talwar stepping down; Umesh Talwar has been elevated to Executive Chairman, while Anuj Talwar has been appointed as Managing Director, Varun Talwar as Vice-Chairman, and Ashish Gupta as CEO effective April 1.

* GHV INFRA PROJECT: The company has secured a Rs.135 crore order from MHK Buildcon for the construction of a water storage pond in Haryana,

* RAILTEL CORPORTAION OF INDIA: The company receives an order from Lucknow Municipal Corporation worth Rs. 16.99 crore. .

* PACE DIGITEK: The company secures a 250 MW solar BESS project order worth Rs. 1,775 crore from KREDL.

* LLOYDS ENGINEERING: Promoter group sells 3.4% stake worth Rs. 248 crore to Thriveni Earthmovers via block deal.

* SALZER ELECTRONIC: The company has re-appointed R. Doraiswamy as Managing Director for a further three-year term and appointed Raman Krishnamoorthy as Chief Financial Officer, effective April 1.

* BRIGADE ENTERPRISES: The company has conducted the Bhoomi Pujan for its World Trade Center project at Kazhakkottam, Kerala, and inaugurated the Brigade Square IT building.

* FIEM INDUSTRIES: The company re-appoints Vineet Sahni as the chief executive officer

Economic News

*India allows 100% FDI in insurance sector under automatic route: India has opened its insurance sector to 100% foreign ownership. This move aims to boost insurance coverage and attract global investment. Foreign investors can now own domestic insurance companies through the automatic route. This policy change aligns with recent amendments to insurance laws.

Global News

* US January deficit narrows 26% YoY to $95 billion as tariff-led revenue surge outpaces spending growth: The U.S. posted a $95 billion budget deficit in January, down 26% YoY, as strong revenue growth driven largely by higher customs duties from Trump-era tariffs outpaced modest spending increases; adjusting for timing factors, the deficit narrowed 63%. January receipts rose 9% to $560 billion, while outlays increased 2% to $655 billion. For the first four months of FY26, the deficit fell 17% to $697 billion, with revenues up 12% and spending up 2%, both at record levels. A sharp rise in net customs duties (YTD $117.7 billion vs $28.2 billion YoY) and a rare $12 billion drop in interest payments also supported the improvement.

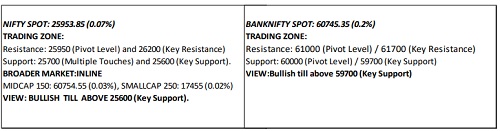

Technical Snapshot

Key Highlights:

Government Security Market:

* The Inter-bank call money rate traded in the range of 4.40%- 5.10% on Wednesday ended at 4.65%.

* The 10 year benchmark closed at 6.7088% on Wednesday Vs 6.7559% on Tuesday.

Global Debt Market:

U.S. Treasury yields moved lower on Wednesday as investors awaited the release of the delayed January jobs report. At 5:10 a.m. ET, the 10-year Treasury yield moved down over 1 basis point to 4.13%, while the 30-year Treasury yield was lower by 1 basis point to 4.772%. The 2-year Treasury note yield was down less than a basis point at 3.447%. Investors are anticipating the nonfarm payrolls report for January on Wednesday, set to be published by the Bureau of Labor Statistics at 8:30 a.m. ET. The report was delayed five days due to the partial U.S. government shutdown, which ended on Feb. 3. The jobs report is projected to show little to no growth in January, with the Dow Jones consensus officially forecasting a payrolls gain of 55,000, after a December increase of 55,000. The unemployment rate is expected to come in at 4.4%, with annual wage gains of 3.7%. Some on Wall Street are predicting lower numbers, with Goldman Sachs, for example, expecting a payrolls increase of just 45,000. Investors are also looking ahead to the consumer price index, which is due out on Friday, and is a key inflation gauge.

10 Year Benchmark Technical View :

The 10 year Benchmark (6.48% GS 2035) yield likely to move in the range of 6.69% to 6.72% level on Thursday.

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer