Stocks in News & Key Economic Updates 06th January 2026 by GEPL Capital Ltd

Stocks in News

* LG ELECTRONIC: The company has signed an Advance Pricing Agreement with the CBDT, eliminating contingent direct tax liabilities of Rs.172.4 crore and royalty-related contingencies of Rs.315.3 crore payable to LG Electronics Inc., Korea.

* WAAREE ENERGIES: The company’s arm has raised Rs.1,003 crore to set up a lithium-ion cell and battery manufacturing unit.

* TATA POWER: The company’s arm achieved 1 GWp of rooftop solar installation capacity within the first nine months of FY26.

* ONGC: A gas leak occurred during workover operations at Well Mori#5 in Andhra Pradesh with no injury or loss of life reported, and the company has also signed a JV agreement with Mitsui OSK Lines for ethane shipping.

* SURAJ ESTATE DEVELOPERS: The company recorded Rs.200 crore in gross bookings from its flagship commercial project, Suraj One Business Bay, within 45 days of launch.

* SAIL: The company reported a 37% YoY increase in sales to 2.1 million tonnes in December 2025.

* DCX SYSTEM: The company has secured an order worth Rs.11 crore for the manufacture and supply of cable and wire harness assemblies.

* NBCC: The company has secured two work orders worth Rs.134 crore in Odisha.

* MAHINDRA AND MAHINDRA: The company has launched the new XUV 7XO with a starting ex-showroom price of Rs.13.66 lakh.

* AWL AGRI: The company reported low single-digit volume growth in Q3, driven by higher demand in edible oil and food & FMCG segments, strong ecommerce performance, and an ~18% YoY expansion in its distribution footprint.

* RAJESH POWER SERVICES: The company has secured a 65 MW / 130 MWh standalone BESS project in Gujarat.

Economic News

* India must end Russian oil ambiguity as tariffs loom: As tensions rise, India faces a pivotal choice regarding its imports of Russian oil, especially with President Trump issuing threats of increased tariffs on Indian products. The stakes are high, as Senator Graham is advocating for penalties on nations linked to Russian oil purchases, further complicating India's trade dynamics. With Indian exports to the U.S.

Global News

* U.S. Manufacturing Slips Deeper Into Contraction as Tariffs Weigh on Demand and Costs: U.S. manufacturing weakened further in December, with the ISM PMI falling to a 14-month low of 47.9, marking the 10th straight month of contraction as tariffs continued to hurt demand, raise input costs, and squeeze margins. New orders, inventories, production, and employment all remained under pressure, with 85% of manufacturing GDP in contraction and most industries reporting declining orders and revenues. While tax cuts and selective tariff exemptions may offer some relief in 2026, economists remain cautious as structural issues, weak capex, and persistent cost inflation limit the prospects of a meaningful near-term recovery.

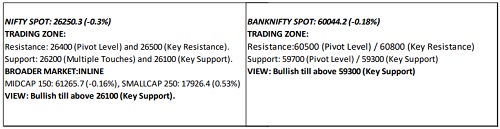

Technical Snapshot

Key Highlights:

Government Security Market:

* The Inter-bank call money rate traded in the range of 4.50%- 5.50% on Monday ended at 4.85%.

* The 10 year benchmark (6.48% GS 2035) closed at 6.6331% on Monday vs 6.6062% on Friday.

Global Debt Market:

Investors are monitoring the Venezuela developments after the U.S. launched strikes on the Latin American country over the weekend. President Nicolás Maduro and his wife Cilia Flores were captured and flown to New York. Maduro — who came into power in 2013 —and his wife were charged with narco -terrorism conspiracy and other crimes in an indictment on Saturday. President Donald Trump said that the U.S. would “run” Venezuela “until such time as we can do a safe, proper and judicious transition,” in a news conference on Saturday, before Secretary of State Marco Rubio appeared to walk back those remarks on Sunday. Rubio made no reference to the U.S. governing Venezuela directly. On the economic data front, the big event of the week will be the December jobs report, due to be released on Friday. Economists polled by Dow Jones expect the economy to have added 54,000 jobs last month. Investors will also parse through data on December’s ISM manufacturing PMI on Monday, JOLTs job openings on Wednesday, and weekly initial jobless claims on Thursday

10 Year Benchmark Technical View :

The 10 year Benchmark (6.48% GS 2035) yield likely to move in the range of 6.62% to 6.64% level on Tuesday

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer