Spreading exposure across various market capitalizations and sectors can help mitigate risks: Franklin Templeton India MF

Franklin Templeton India Mutual Fund has released their June 2025 market outlook press note. The fund house advises investors to spread exposure across various market capitalizations and sectors to mitigate risks. According to the asset manager global markets are likely to remain cautious as tariff-related risks, there is a favourable balance between FII inflows and stake sales/IPOs crucial to maintain market stability and valuations and lastly the short-duration funds positioned with a tilt toward maximizing duration.

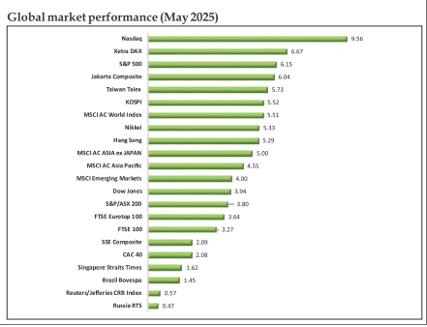

Global markets are likely to remain cautious as tariff-related risks begin to reflect in economic data. While inflation remains contained for now, concerns persist about potential impact of tariffs on both inflation and growth. US markets have been supported by hopes that tax cuts could offset drag on growth from tariffs. However, these have implications for the US fiscal deficit and could reduce space for the Federal Reserve to cut rates. These create risks for the US markets over the medium term. Broadly, developed market central banks have been mixed in response to the ongoing global economic uncertainty - some held rates steady, others cut modestly - though Japan remains an outlier in raising rates. The US dollar may stay under pressure amid fiscal concerns and rising bond yields. Overall, policy remains supportive, but trade tensions and inflation risks warrant close monitoring.

Despite ongoing concerns around global trade dynamics and a perceived slowdown in domestic economic momentum, Indian equity markets have remained resilient year-to-date. Large-cap indices, continue to provide stability with the Nifty 50 gaining 4.7%. Small- and mid-caps are showing signs of a recovery. From a macroeconomic standpoint, Franklin Templeton India is witnessing a gradual, albeit uneven, improvement in activity. Business indicators such as Purchasing Manager Index (PMI) and CST collections remain healthy, while power demand has been relatively weak-likely due to a high base, milder summer, and early monsoons.

Government capital expenditure saw a significant uptick in Q4FY25, although some of it was concentrated in specific areas like telecom, which may not reflect broad-based infrastructure momentum. This capex push helped GDP growth for the quarter, but the quarter’s pace is unlikely to sustain based on budget estimates for FY26. While aggregate capex growth for listed companies appears healthy, commentary from capital goods firms suggests muted sentiment, likely influenced by global tariff uncertainties. Credit growth has weakened to about 10%. Household capes, particularly in real estate, is also showing divergence-affordable and mid- income housing demand has softened, while premium housing continues to hold up with 15-20% value growth across cities.

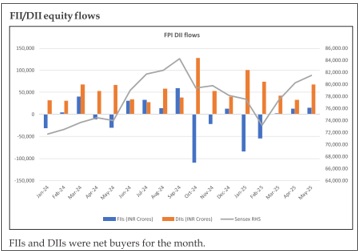

Flows remain a critical factor in shaping the near-term trajectory of Indian equity markets. Foreign Portfolio investor (FP) sentiment has turned positive, with India emerging as a key beneficiary among global emerging markets over the past three months, attracting approximately INR 29,875 crore. This has provided a supportive backdrop for equities. However, supply-side pressures are building. In May alone, promoter and private equity stake sales amounted to approximately INR 53,000 crore-lower than the peak levels seen in Q4 CY24 but still substantial. Additionally, a pipeline of IPOs worth around INR 20,000 crore is expected to hit the market, which could further absorb liquidity. Retail participation has also picked up, particularly in the small- and mid-case segments, but could be highly sensitive to global cues and market volatility.

Going forward, two key variables will be crucial to monitor: the sustainability of FI inflows and the pace of equity supply through stake sales and IPOs. A favorable balance between these two will be essential to maintain market stability and support valuations.

On the earnings front, Franklin Templeton India is witnessing signs of stabilization with moderate earnings growth expected for FY26 and FY27. The ratio of downgrades to upgrades has improved, but much will depend on the macro environment in the second half of FY26. Valuations remain elevated, with the Nifty's one-year forward P/E trading above its long-term average at 21X (near the 1 standard deviation mark), though it is supported by India's relative macro strength. Unless a significant negative event occurs, FTI does not anticipate a sharp derating and market returns are likely to mirror earnings growth. FTI remain focused on bottom-up stock selection and prudent sector allocation based on earnings growth to navigate evolving landscape.”

Opportunities for investors

Equity investing requires investors to be prepared to invest in times of uncertainty. Investors who stay disciplined and patient are likely to come out ahead in the long run. Given the current global uncertainties, adopting a systematic approach with a diversified investment strategy would be prudent. Spreading exposure across various market capitalizations and sectors can help mitigate risks while uncovering potential opportunities. Hybrid funds may offer optimal risk-adjusted returns during such volatile periods.

Bond market highlights

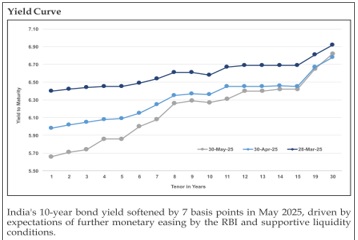

Short-duration funds (up to one year duration) are currently positioned with a tilt toward maximizing duration within regulatory limits, in anticipation of a stable monetary policy and sustained system liquidity. This strategy is supported by the Reserve Bank of India's substantial 50 basis point rate cut and a significant INR 2.7 lakh crore dividend transfer to the government, along with the recent announcement of a cut in the Cash Reserve Ratio (CRR)-all of which are expected to significantly boost core liquidity and keep short-term yields well-supported.

The yield curve has steepened notably, with short-term yields declining more sharply than long-term ones, as the RBI has indicated that monetary policy has limited room left to support growth. Additionally, the Monetary Policy Committee (MPC) has shifted its stance from "accommodative" to "neutral," signaling that we are nearing the end of the rate cutting cycle. The FTI investment team remains vigilant and prepared to recalibrate the strategy should global volatility intensify, whether due to tariff developments or geopolitical tensions. For now, the strategy for longer-duration funds is to focus on the short to intermediate segments of the yield curve with an accrual bias, thereby leveraging the favorable domestic macroeconomic environment to enhance returns across fixed income portfolios.

FTI believes that the RBI would be very careful in easing the monetary policy further after having reduced the policy repo rate by 100 bps in quick succession since February 2025, Since, Monetary Policy Committee (MPC) also decided to change the stance from accommodative to neutral, it will carefully assess the incoming data and the evolving outlook to chart out the future course of monetary policy in order to strike the right growth-inflation balance.

FTI’s fixed income funds have been positioned with optimal duration within the respective fund mandate. FTI finds the short to intermediate part of yield curve promising from the risk return perspective due to adequate liquidity and relatively lesser room for further rate cuts.

Source: Bloomberg, RBI, MOSPI, Morgan Stanley

Above views are of the author and not of the website kindly read disclaimer

Tag News

Fund Folio : Equity AUM rises for the 12th successive year; net inflows moderate in CY25 by ...