Spot Gold is expected to hold the support at $3350 and move higher towards $3400 - ICICI Direct

Bullion Outlook

* Spot Gold is likely to move higher towards $3400 on safe haven demand driven by renewed tariff concerns and geopolitical uncertainty. Precious metals will continue to seek safe-haven demand due to geo-political uncertainty. US President has threatened to impose 200% tariff on Chinese goods if China refuses to sell magnets to the US. Furthermore, US political uncertainty and concerns over Fed independence would also provide support to the yellow metal. Additionally, fund buying will continue to support prices as gold ETFs rose to 2-year highs last week and silver holdings in ETFs reached 3-year highs.

* Spot Gold is expected to hold the support at $3350 and move higher towards $3400. MCX Gold October is expected to rise towards Rs.101,400 as long as it remains above Rs.100,100 level.

* MCX Silver Sep is expected to rise towards Rs.117,200 as long as it holds above Rs.115,000 level. A move above Rs.117,200 it would rally towards Rs.118,400.

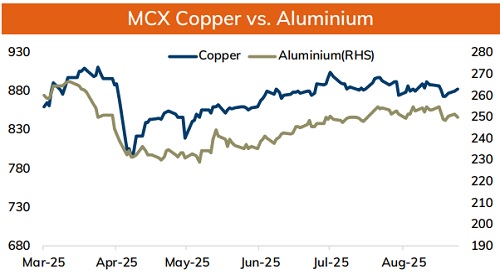

Base Metal Outlook

* Copper prices are expected to hold its ground and move north on improved risk sentiments and growing probability of loose monetary policy from US Federal Reserve. Further, expectation of better than expected US house price index and manufacturing activity would support the base metals to stay firm. Meanwhile, tariff concerns and rising inventory levels would restrict any major up move in the metal prices.

* MCX Copper September is expected to hold its ground and move higher towards Rs.900, as long as it trades above Rs.88level. A move above Rs.900, it would rally towards ?906.

* MCX Aluminum September is expected to move higher towards Rs.255, as long as it trades above Rs.250 level. MCX Zinc September is likely to hold the 50-day EMA at Rs.265 and rebound towards Rs.271 level.

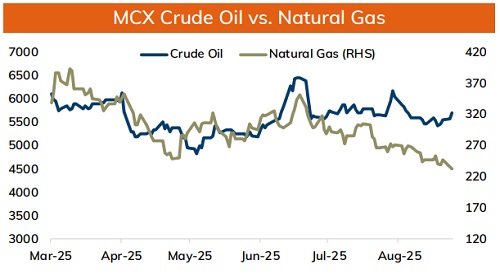

Energy Outlook

* Crude oil is likely to hold its ground and move higher on supply risk and uncertainty over Russia-Ukraine peace talks. US has threatened to impose additional tariffs on Russia’s trading partners or fresh sanction on Russia could be imposed if no progress is made towards a peace deal within the next two weeks. Addition to that, stalled Russia-Ukraine peace talks and recent attacks has heightened fears of supply disruption. Moreover, improved risk sentiments amid higher rate cut bets by the Fed would support oil prices.

* On the data front, 60 put strike has higher OI concentration which would act as key support. On the upside 65 call strike, has higher OI concentration, which would likely to act as immediate hurdle. Above $65 it would rise towards $66.50. MCX Crude oil September is likely to hold the support at Rs.5580 and rise towards Rs.5780 level.

* MCX Natural gas September future is likely to slide toward Rs.236, as long as it trades under Rs.254.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631