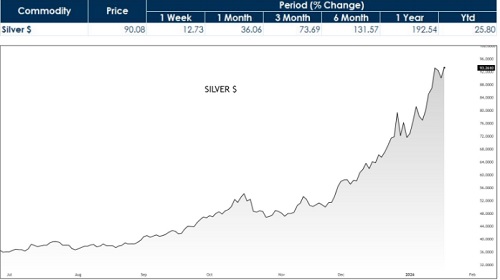

Silver`s Inflection Point: Macro Stress Meets Technical Breakout by Kedia Advisory

Key Highlights

* Silver shows early signs of transitioning into higher range

* Macroeconomic conditions remain broadly supportive for precious metals

* Industrial demand trends remain firm amid limited supply responsiveness

* Technical structure indicates improving medium-term trend stability

* $100 serves as an indicative medium-term reference level

* Elevated volatility and policy shifts remain key downside risks Silver markets are experiencing heightened volatility, driven by a complex interplay of geopolitical developments, policy uncertainty, and underlying structural supply-demand dynamics. While recent price action has been sharp and at times disorderly, the broader trend continues to suggest a market in transition rather than exhaustion

Silver rose more than 4% at the start of the week, briefly approaching $94 per ounce, following renewed geopolitical tension after US President Donald Trump threatened new tariffs on eight European nations in connection with negotiations over Greenland. The announcement triggered a classic risk-off response across global markets, with investors rotating into safe-haven assets such as gold and silver, while equities and risk assets weakened. However, the rally was followed by profit-taking and a sharp pullback toward the end of the week, underscoring the market’s sensitivity to policy signals and positioning. Silver volatility escalated after US President Donald Trump announced plans to impose 10% tariffs from February 1 on imports from eight European nations, with the rate potentially rising to 25% by June if negotiations over Greenland fail. The announcement triggered a sharp risk-off reaction, driving silver over 4% higher toward $94 per ounce, while gold climbed above $4,670 per ounce, both marking record highs.

Although the US administration later clarified that critical minerals, including silver, would be exempt due to silver’s inclusion on the US critical minerals list in 2025, the episode heightened concerns over trade retaliation. European officials discussed countermeasures, including potential levies on €93 billion of US goods, reinforcing silver’s role as a geopolitical hedge amid rising policy uncertainty

Impact on Silver Flows

The tariff threat announced by US President Donald Trump, proposing 10% tariffs from February 1 and up to 25% by June on imports from eight European nations, had a measurable impact on silver flows and pricing despite silver’s later exemption as a critical mineral. Immediately after the announcement, silver prices surged over 4% intraday to around $94/oz, reflecting a sharp increase in safe-haven demand and logistical risk premium. London remains a key physical hub, accounting for a significant share of global silver clearing and storage.

Over the past year, LBMA vault data has shown persistent inventory drawdowns, driven largely by strong demand from India and China. The tariff threat raised fears that cross-Atlantic silver movements—used by bullion banks to balance shortages between London and New York—could become costlier or less predictable, even if not directly taxed. This uncertainty prompted precautionary stockpiling and reduced willingness to release inventories, tightening near-term availability.

Although silver was later confirmed as exempt due to its inclusion on the US critical minerals list (2025), the episode demonstrated how policy risk alone can disrupt flows, elevate volatility, and sustain higher price levels in an already supply-constrained market.

Supply Constraints and Market Tightness

Despite recent price volatility, silver’s underlying supply–demand balance remains structurally tight and data-supported. Global silver supply has grown only marginally, with mine production increasing by ~1–2% annually, constrained by declining ore grades and rising all-in sustaining costs, which now average $18–22 per ounce for primary silver producers. Importantly, nearly 70% of global silver output is produced as a by-product of copper, zinc, and lead mining, limiting the sector’s ability to respond quickly to higher silver prices.

On the physical side, the London market has shown recurring tightness. LBMA vault holdings declined meaningfully over the past year, reflecting sustained outflows to Asia, particularly India and China, where combined silver imports rose sharply on a year-on-year basis. Estimates suggest that a large share of remaining London inventories are ETF-encumbered, reducing freely available metal during demand spikes and increasing the risk of temporary squeezes.

Meanwhile, industrial demand continues to expand. Silver usage in solar photovoltaics alone now accounts for ~15–20% of total global demand, while electronics, EVs, and digital infrastructure add further structural consumption. This combination of constrained supply and non-cyclical demand underpins ongoing market tightness.

Macro Backdrop: Rates, Debt, and Confidence

The macroeconomic environment remains mixed but medium-term supportive for silver, underpinned by elevated debt levels and constrained policy flexibility. US Treasury yields have moved higher, with the 10-year yield rising to ~4.23%, the highest level in over four months, supported by resilient macro data—industrial production and retail sales both exceeded expectations—and renewed uncertainty around the future independence and leadership of the Federal Reserve.

Higher nominal yields and a firmer US dollar contributed to silver’s recent pullback, as non-yielding assets typically face short-term pressure in such environments. However, real yields remain modest by historical standards when adjusted for forward inflation expectations, which are still hovering near 2.3–2.5%. At the same time, US federal debt has crossed $34 trillion, limiting the scope for policymakers to sustain restrictive monetary policy without increasing fiscal stress.

Markets remain highly sensitive to upcoming PCE inflation and GDP data, which will shape expectations around rate cuts later in the year. In the absence of a clear and sustained disinflation trend, real rates are likely to remain a medium-term tailwind for precious metals, including silver.

Above views are of the author and not of the website kindly read disclaimer