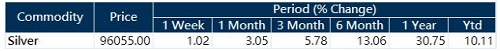

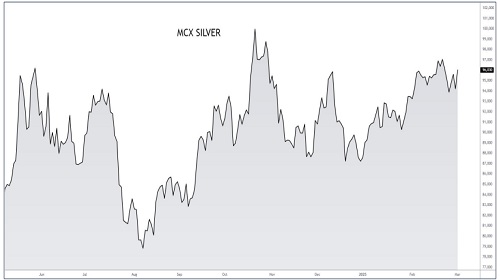

Silver gained 3.05% in a month on Dollar weakness, tracking gains from Gold - Kedia Advisory

Strengths

* Silver gained 3.05% in a month on Dollar weakness, tracking gains from Gold.

* Safe-haven demand amid trade tensions – US tariffs and countermeasures by China drive silver buying.

* Weaker US Dollar – Dollar index fell as European leaders supported a Ukraine peace deal.

* Industrial silver demand growth – Silver industrial fabrication projected to grow 3% in 2025, surpassing 700 mn ounces.

* Improving investment sentiment – Tactical investors covering shorts, boosting futures and spot silver prices.

* US public debt concerns – Rising debt levels drive investor interest in safe-haven metals like silver and gold.

Weaknesses

* Weak jewellery demand in India and China – Indian silver jewellery demand to decline 6% due to high domestic prices.

* US silver coin sales drop – Purchases fell 27% YoY in January to 3.5 moz, lowest since 2018.

* Mining production increase – Hecla Mining reported a 13% YoY increase in silver output to 16.2 moz.

* Higher silver mine output – Global silver supply projected to grow 3% to 1.05 bn ounces in 2025.

* Impact of strong Treasury yields – Rising US bond yields may limit silver investment despite macro uncertainties

Opportunities

* Growing silver ETF inflows – Institutional investors may turn to silver amid equity overvaluation concerns.

* China’s economic recovery – China’s Manufacturing number recovered, any other policy support or stimulus could revive Chinese silver consumption.

* US trade policy risks – Tariffs and economic uncertainty could further boost silver’s safe-haven appeal.

* Geopolitical uncertainty support – Continued Russia-Ukraine tensions keep silver in focus as a risk hedge.

* Recycling limitations – Silver recycling still insufficient to offset growing demand.

* Silver market deficit – Deficit expected 19% to 149 mn ounces, reducing supply-side price support.

Threats

* Seasonally bearish gold market – Historical patterns suggest gold may correct 6-9%, dragging silver down.

* Profit-taking in silver investments – Short-term traders may exit positions after recent price spikes.

* Slower global economic growth – Weaker industrial demand could cap silver’s upside despite long-term gains.

* Declining Indian demand – Domestic liquidation trends could weaken silver’s price support from key Asian markets.

* Mining expansions adding supply – A 2% rise in mine output to 844 mn ounces could limit price appreciation.

* Silver Market Deficit: The silver market is expected to remain in deficit for the fifth consecutive year, with a shortfall of 149 Moz, a 19% reduction from 2024 but still historically significant.

* Industrial Demand Growth: Silver industrial fabrication is projected to rise by 3% to over 700 Moz, driven by photovoltaics, automotive electrification, and AI-related consumer electronics.

* Physical Investment Uptick: Silver physical investment is forecast to grow by 3%, supported by stronger demand in Europe and North America, while high prices in India may trigger some liquidations.

* Decline in Jewelry & Silverware Demand: Jewelry demand is expected to drop by 6%, mainly due to high prices in India and cautious Chinese consumer spending, while silverware demand is set to fall by 16%.

* Silver Supply Growth: Global silver supply will increase by 3% to 1.05 billion ounces, driven by higher mine production (844 Moz) and a 5% rise in recycling, particularly from industrial scrap.

* Mining Expansion: Increased silver output is expected in China, Canada, Chile, and Morocco, with key contributions from base metal and gold operations, along with ramp-ups at major mining projects.

* Geopolitical & Economic Impact: Investor sentiment towards silver has improved due to geopolitical uncertainties, trade concerns under Trump’s second term, and inflationary pressures, despite headwinds from a strong dollar.

* Impact of US Tariffs: Fears over Trump’s potential tariff policies have fueled silver price recovery, but concerns about global economic growth, particularly in China, could limit investor enthusiasm in industrial metals.

Above views are of the author and not of the website kindly read disclaimer