Sell JPYINR Mar @ 59 SL 59.2 TGT 58.7-58.5 - Kedia Advisory

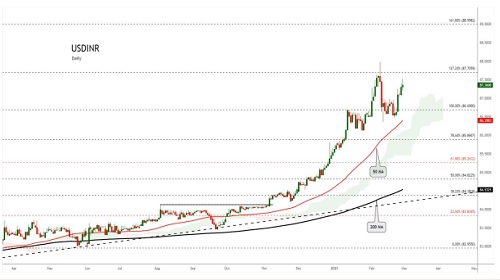

USDINR

BUY USDINR MAR @ 87.4 SL 87.3 TGT 87.55-87.65.

Observations

USDINR trading range for the day is 87.28-87.64.

Rupee closed slightly higher tracking a rise in Asian peers, while dollar demand kept a lid on the gains.

Concerns about weakness in the U.S. economy have weighed on the dollar and U.S. bond yields

The HSBC India Manufacturing PMI fell to 56.3 in February 2025, below initial estimates of 57.1 and January’s 57.7.

EURINR

BUY EURINR MAR @ 91.9 SL 91.7 TGT 92.15-92.35.

Observations

EURINR trading range for the day is 91.24-92.52.

Euro rose as news of potential increases in Eurozone defense spending lifted sentiment.

Euro Area inflation eased slightly to 2.4% in February, though still above forecasts.

Investors now await the ECB’s policy meeting, where a fifth consecutive rate cut is expected.

GBPINR

BUY GBPINR MAR @ 111 SL 110.7 TGT 111.3-111.6.

GBPINR trading range for the day is 110.57-111.57.

GBP strengthened as optimism grew around a potential Ukraine peace plan led by European leaders.

GBP also gained strength from expectations that UK interest rates will remain higher for longer.

BOE’s Ramsden highlighted that persistent wage pressures could keep inflation above target

JPYINR

SELL JPYINR MAR @ 59 SL 59.2 TGT 58.7-58.5.

Observations

JPYINR trading range for the day is 58.54-59.18.

JPY strengthened as demand for safe-haven assets surged amid growing concerns over tariff risks.

Support seen as softening US economic data increased expectations of further interest rate cuts by the Federal Reserve.

Japan’s unemployment rate unexpectedly rose to 2.5% in January from 2.4% in December