Sell JPYINR Mar @ 59.2 SL 59.4 TGT 58.9-58.7 - Kedia Advisory

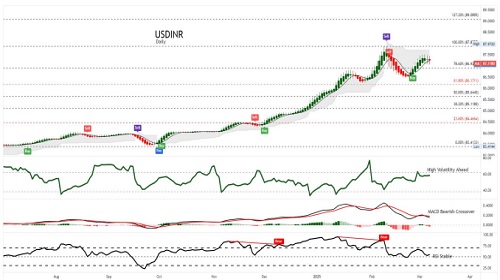

USDINR

BUY USDINR MAR @ 87.2 SL 87.05 TGT 87.35-87.5.

Observations

USDINR trading range for the day is 87.13-87.61.

Rupee strengthened supported by likely intervention by the central bank and a rise in Asian currencies

Worries about growth have also prompted traders to raise bets on rate cuts by the Federal Reserve this year.

Traders are now pricing in 85 bps of easing from the Fed this year, compared to 75 bps on Monday, LSEG data showed.

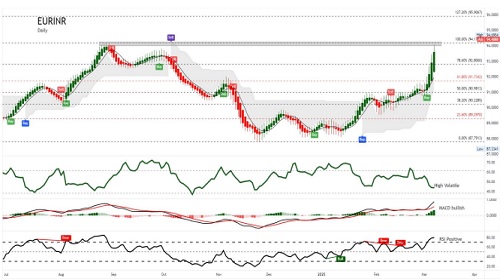

EURINR

SELL EURINR MAR @ 95.25 SL 95.5 TGT 95-94.75.

Observations

EURINR trading range for the day is 94.5-95.7.

Euro gains as pledges of higher deficit spending among the Eurozone's major economies supported a stronger growth outlook.

ECB signaled that monetary conditions in the bloc are becoming less restrictive following their widely expected rate cut last week.

Conversely, stark growth concerns in the US pressured the greenback and magnified the increase in the currency pair.

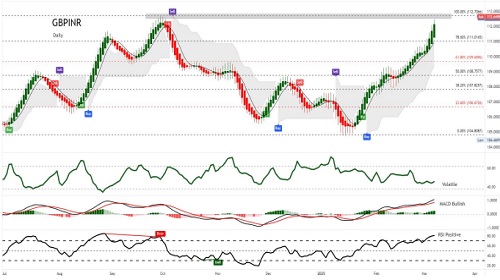

GBPINR

SELL GBPINR MAR @ 113 SL 113.3 TGT 112.7-112.5.

Observations

GBPINR trading range for the day is 112.28-113.26.

GBP dropped as traders stayed wary amid continued uncertainty about global economic conditions.

Data by the British Retail Consortium and KPMG showed that retail sales growth slowed again in February.

BOE’s Ramsden warned that persistent wage pressures could keep inflation elevated but suggested future rate cuts could accelerate if needed.

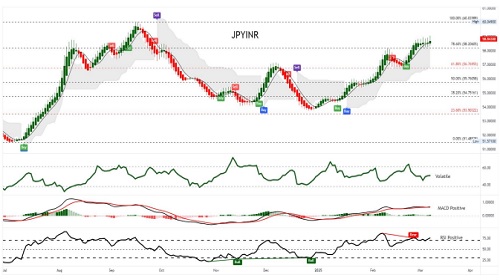

JPYINR

SELL JPYINR MAR @ 59.2 SL 59.4 TGT 58.9-58.7.

Observations

JPYINR trading range for the day is 58.66-59.74.

JPY dropped on profit booking after rising as growing US recession fears fueled demand for safe-haven assets.

Japan's Economy Minister Akazawa said the government will work closely with the BOJ in reaching its 2% inflation target

The Japanese economy expanded by 2.2% on an annualized basis in Q4 2024