SELL GBPINR OCT @ 118 SL 118.3 TGT 117.7-117.5 - Kedia Advisory

USDINR

SELL USDINR OCT @ 88.3 SL 88.45 TGT 88.15-88.

Observations

USDINR trading range for the day is 87.29-88.79.

Rupee logged its worst day in a month as a drop below the 88 per U.S. dollar mark.

India’s economic growth outlook for the current fiscal year remains strong.

India’s trade performance for September 2025 showed early signs of diversification in export destinations.

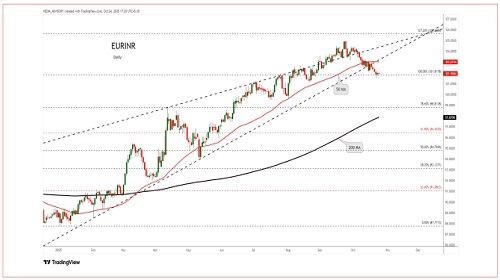

EURINR

SELL EURINR OCT @ 103 SL 103.3 TGT 102.7-102.4.

Observations

EURINR trading range for the day is 101.83-103.27.

Euro remained firm marked by upbeat Eurozone PMI figures and weaker-than-expected US inflation data.

The October PMI showed the Eurozone’s private sector expanding at its fastest pace since May 2024, driven by robust services growth and stabilizing manufacturing.

Moody's maintained France's long-term foreign-currency sovereign credit rating at Aa3, but revised its outlook to negative from stable.

GBPINR

SELL GBPINR OCT @ 118 SL 118.3 TGT 117.7-117.5.

Observations

GBPINR trading range for the day is 116.85-118.29.

GBP gains amid upbeat UK Retail Sales and flash S&P Global PMI data.

The ONS reported that Retail Sales, surprisingly rose by 0.5% on a monthly basis, while these were expected to decline by 0.2%.

UK’s private sector business activity expanded at a faster pace due to a strong rebound in the manufacturing sector.

JPYINR

SELL JPYINR OCT @ 57.9 SL 58.1 TGT 57.7-57.5.

Observations

JPYINR trading range for the day is 57.33-57.95.

JPY gains amid expectations of aggressive fiscal expansion under the new government and uncertainty over BOJ’s policy outlook.

BOJ is widely expected to keep rates steady, though policymakers are set to debate the conditions for resuming rate hikes as tariff-related risks ease.

Investors also await Takaichi’s meeting with US President Donald Trump this week for additional policy signals.