SELL GBPINR JUL @ 117.7 SL 118 TGT 117.4-117.2. - Kedia Advisory

USDINR

SELL USDINR JUL @ 85.65 SL 85.8 TGT 85.5-85.38.

Observations

USDINR trading range for the day is 85.43-85.87.

Rupee had its best week since January 2023, as an Iran-Israel ceasefire cooled oil prices and sapped safe-haven dollar demand.

India Ratings and Research anticipates a rebound in banking sector credit growth, spurred by the Reserve Bank of India's rate cuts.

Icra has retained India's GDP growth forecast for FY26 at 6.2%, contingent on favorable monsoons and stable crude oil prices.

EURINR

SELL EURINR JUL @ 100.5 SL 100.75 TGT 100.2-100.

Observations

EURINR trading range for the day is 100.19-100.69.

Euro dropped as Euro zone economic sentiment deteriorates in June

The economic sentiment indicator in the Euro Area edged down to 94 in June 2025 from 94.8 in May.

The Euro Area consumer confidence indicator edged down by 0.2 points to -15.3 in June 2025 from -15.1 in May, in line with preliminary estimates.

GBPINR

SELL GBPINR JUL @ 117.7 SL 118 TGT 117.4-117.2.

Observations

GBPINR trading range for the day is 117.41-117.91.

GBP dropped growing concerns over the labor market strength and increasing upside inflation risks.

BoE’s Bailey warns of labor market risks due to an increase in employers’ contributions to National Insurance.

Traders have priced in two interest rate cuts of 25 bps in the remainder of the year that will push borrowing rates lower to 3.75%.

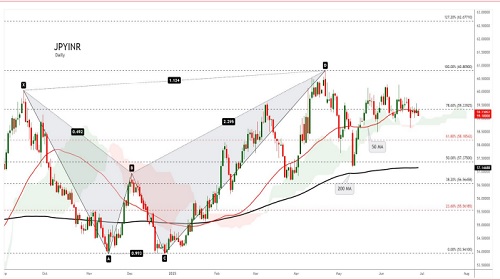

JPYINR

SELL JPYINR JUL @ 59.75 SL 60 TGT 59.5-59.25.

Observations

JPYINR trading range for the day is 59.74-59.74.

JPY dips on profit booking after gains as Fed cut bets hit dollar

Retail sales in Japan increased by 2.2% year-on-year in May 2025, down from an upwardly revised 3.5% rise in the previous month.

Japan’s unemployment rate held steady at 2.5% in May 2025 for the third consecutive month, matching market expectations.