RP-Sanjiv Goenka Group : Onward and Upward – Continuing growth momentum by Emkay Global Financial Services

We met Dr Sanjiv Goenka (SG), Chairman of RPSG Group, in a 1x1 meeting in Kolkata in early April. We see the Group significantly accelerating growth in the next five years, via entering more value-added businesses with fresh capacities and improved margins. The Group has seen remarkable transformation in its leadership and HR culture which has helped improve growth via better execution and movement up the value chain. CESC, in our view, could be the leader in value creation for the Group in coming years

Cusp of next growth stage

The Group is poised to accelerate topline growth with improved margins across most of its businesses. The asset-driven businesses are on a capex drive, with Rs500bn capex over the next 3-4 years which should start to show results from FY27. Moreover, there is a focus across segments to enter more value-added businesses with new products and improved margins. This should drive Group EBITDA growth of +20% over FY25-30 vs low teens in prior five years, and ROE expansion from the current 13-15% levels. There is some lead-lag across businesses, but the medium-term building blocks are in place.

M&A – Key growth driver; prudent strategy

The Group has made significant M&As across businesses for driving growth. The objectives have been multifold – enter new domains and product verticals, add fresh expertise, and broaden the client base. The Group has been prudent in its overall M&A strategy, and has followed discipline in neither overpaying for acquisitions nor stretching the acquirer’s balance sheet. The integration track record has been strong so far, but the real tests are coming up, especially with the Aquapharm integration in PCBL.

Conservative on balance sheet

The Group is in aggressive growth mode, but there is overall caution on balance-sheet stress. Group leverage could reach a peak of 1.5x from 1.2x (FY24), but new project cash flows will kick in from that point on. A majority of the debt (53%) is in CESC, where risks are low as interest costs are largely pass-throughs and a large part of the output from new renewable projects will be earmarked for captive consumption. The Chairman clarified that they would keep an eye on the balance sheet and raise equity, if needed.

Management changes A remarkable

HR transformation is the cornerstone of the Group’s growth acceleration. At the ground level, the Chairman has driven a change to a performance-oriented culture, and such transition is now almost complete. New leadership, brought in across businesses, have been enablers of this new growth mantra. The Chairman’s office has been strengthened with the addition of a partner from McKinsey and former CFO of HCL Tech. The Group leadership focuses on both, strategy and execution. One important practice is weekly monitoring of all businesses’ operations and financial metrics.

Sports ventures building critical mass

The Group now has significant presence in sports, with Lucknow Super Giants, Mohun Bagan Super Giants, and a new investment in Manchester Originals. LSG is the biggest venture and is seeing strong traction in viewership and fan base – on-ground results and the investment in Rishabh Pant should help bridge the brand gap with older franchises (Mumbai Indians, Chennai Super Kings, and Royal Challengers Bangalore). There are no immediate plans to list it – SG believes that operating leverage will kick in once the broadcasting rights are re-bid in 2027.

Multiple catalysts across the Group

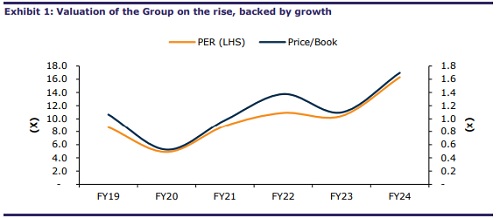

The Group market cap has seen 32.2% CAGR over the last four years, primarily led by FSOL, which is up 60% during the same period. We believe the next wave of value creation of the Group will come from CESC. CESC’s entry into hybrid renewables has been timely, and synergy with the distribution business gives it a lower risk profile vs peers. Moreover, the growth outlook for its distribution license business is also improving. Cash flows should improve once the renewable projects come on-line. The stock trades at a conservative 1.5x P/B and 12x EV/EBITDA (Consensus FY25).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354