Rising Three Candlestick after breakout above 25700 signals strong bullish momentum - Tradebulls Securities Pvt Ltd

Nifty

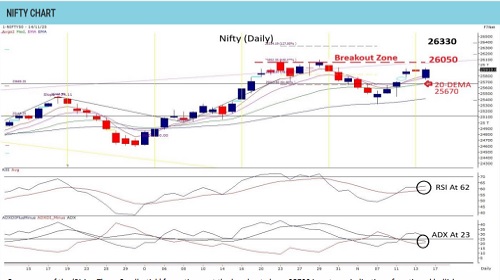

Occurrence of the ‘Rising Three Candlestick’ formation post the breakout above 25700 is a strong indication of continued bullish momentum. A decisive move above 26050 on an immediate basis is expected to further amplify the up move towards 26330, supported by potential short squeeze activity. Weekly RSI rebounding at 61 alongside ADX turning up near 19 reinforces strengthening trend conditions, while daily indicators remain firmly aligned with the ongoing uptrend. Immediate support at 25670 appears stable, whereas pattern support at 25440 remains crucial for keeping the broader up move valid. Options data positions 25800 as the near-term base, with upside for the week likely to find resistance near 26500. The market is likely to accelerate its bullish momentum in the coming weeks. Traders can consider adding aggressive fresh longs above 26050, aiming for 26330 initially and 27000 thereafter. Protective stops should be placed below 25440 currently, and trailed higher as the trend progresses to manage risk effectively.

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838