Retail & Dispatch Sales Pulse: August 2025 by Choice Broking Ltd

Auto OEM Dispatch

In August 2025, 2W sales surged, with Eicher up 54.8% and TVS up 30.1% YoY, driven by premium demand. The PV segment saw a decline in sales in the domestic market, with M&M down 9.0% YoY. MSIL was flat YoY, primarily supported by strong exports. The CV segment saw modest gains.

Auto Retail Sales

The automotive industry last month saw a 2.8% YoY growth in retail sales. While 2W, PV, CV and tractor segments exhibited increase, 3W sales declined 2.3% YoY.

CNG and EV Penetration

The PV segment witnessed increased CNG penetration, while 3Ws saw a decline due to a shift towards EVs. CVs also recorded higher CNG adoption. EV penetration deepened across the segments but overall remained low as adoption continues to be constrained by infrastructure, range concerns and challenges due to the rare earth magnet crisis. Inventory Analysis

Dealer inventory levels were mixed across key vehicle segments. PV inventory was at lower levels, with Maruti Suzuki and M&M maintaining lower stock before the anticipated GST rate changes. CV inventory, led by Ashok Leyland, showed a decline, easing dealer pressure after a subdued year.

Auto OEM Dispatches:

Mixed August Sales – 2W OEMs lead growth

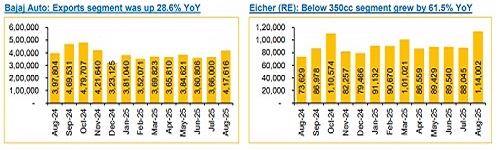

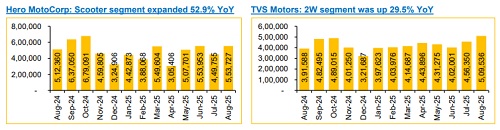

*In August 2025, OEMs in the 2W segment recorded strong growth, supported by robust export performance and domestic recovery. Domestic market saw an improvement, with dealers stocking up in anticipation of a strong demand owing to GST structure changes announced by the Prime Minister. TVSL and EIM led the segment with YoY dispatch growth of 30.1% and 54.8%, respectively, driven by premium motorcycle demand and successful new launches. HMCL posted a 8.1% YoY increase, aided by rural recovery. BJAUT saw a 5.0% increase due to weak domestic demand, although its exports grew 28.6%, partially offsetting the softness.

* The OEMs in the PV segment saw a decline in sales, with dealers carrying a light inventory before GST rate changes come into effect. M&M reported a 9.0% YoY fall in dispatches. MSIL saw a 0.6% YoY decrease in dispatches, primarily supported by strong exports, while its domestic segment witnessed a decline.

* The CV segment saw a modest growth, with M&M’s CV division was up 10.3% YoY, Ashok Leyland rising 5.4% YoY, Eicher Motors (VECV) growing 9.5% YoY and Tata Motors increasing 9.8% YoY.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131