RBI: Monetary Policy and Economic Outlook Briefing by Choice Broking Ltd

CIE View & Forecasts

RBI’s MPC unanimously voted to cut the repo rate by 25 bps to 5.25%, while maintaining a neutral stance, which is in-line with our expectation. Inflation at record lows (0.25% YoY for Oct, 25) and weak high-frequency indicators were the critical factors on which the decision was based. Further, a stronger case of rate cut was also supported by 69 bps reduction in Weighted Average Lending Rates (WALR) for fresh rupee loans from January to October, 25.

We expect credit to grow in the range of 11.5%–12.0% for FY26E. Lower global interest rates, expected softer inflation and challenging demand environment drive our forecast for another 25 bps cut by Q1FY27E.

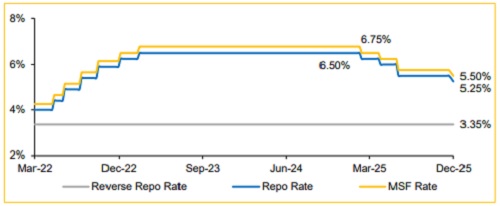

Repo Rate Cut by 25 bps to 5.25% with a Neutral Stance

* Both Repo Rate (short-term rate) and Bank Lending Rate (long-term rate) were reduced unanimously by 25 bps to 5.25% and 5.50%, respectively. Rate cut was driven by current growth-inflation dynamics and benign inflationary scenarios against the backdrop of weak high-frequency indicators.

* Similarly, SDF Rate and MSF Rate (overnight rates) were cut by 25 bps to 5.0% and 5.5%, respectively,

Over the last 12 months, repo rate has been cut by 125 bps

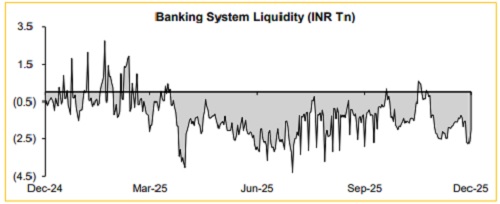

RBI to Inject ~INR 1.4 Tn in A Bid to Sway Credit Growth Higher

* To maintain adequate and sustained liquidity in the system, RBI has announced OMO purchases of INR 1.0 Tn in two tranches of INR 500 Bn each, to be held on December 11 and December 16, 2025.

* Further, RBI will conduct a USD 5 Bn auction of USD-INR swaps for a tenor of up to 3 years, on December 16, 2025, so as to support liquidity in the forex market and curb volatility.

Liquidity surplus of INR ~2.6 Tn is likely to support stronger credit growth

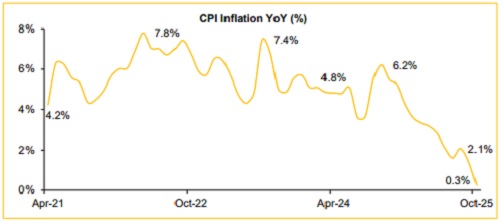

Inflation at Decadal Lows: Weak Commodity Pricing and Soft Demand

* CPI inflation for Oct-25 stood at multi-year low of 0.25%, declining for the third consecutive month. Food inflation with 50%+ weight was a major contributor to soft prices, coming in at -5.0% in October 2025 (vs. 10.87% Oct, 24).

* RBI expects average inflation of 0.6% and 2.9% for Q3FY26E and Q4FY26E, respectively. For FY26E inflation is forecasted to be 2.0%. However, as base effect kicks in, inflation is expected to improve to 3.9% and 4.0% in Q1FY27E and Q2FY27E, respectively.

* Core inflation in October, 2025 stood in a narrow range of 4.3%–4.4%, while Core inflation (ex. gold) came in at 2.6%.

* Higher kharif production, healthy rabi sowing, adequate reservoir levels and conducive soil moisture contributed to a lower food inflation.

Lower food Inflation causes CPI to come in at 0.3% for October, 2025

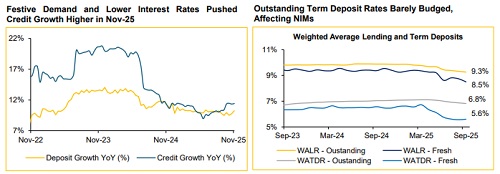

Credit Growth to Recover Further as Rate Transmission Remains Satisfactory

* WALR for Fresh Loans witnessed a reduction of 69 bps from January, 2025 to September, 2025 in line with RBI expectations.

* Moreover, credit growth for the fortnight ended November 14 was 11.5% YoY. Further, driven by the current rate cut and better transmission of previous cuts, we expect credit growth to come in the range of 11.5%–12.0% by FY26E.

* Systematic deposit growth stood at 10.2% YoY as of November 14, 2025.

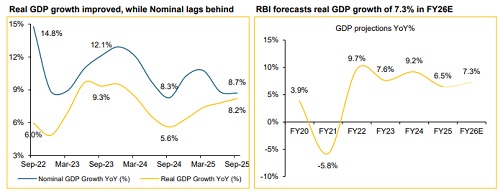

Healthy Manufacturing and Agri Growth Led to A Higher GDP Growth Projection for FY26E

* Real GDP growth in Q2FY26 came in at 8.2%, driven by robust imports (+12.8%), consumption (+7.9%) and capex (+7.3%). Sectorally, growth was led by financial, real estate and professional services (+10.2%), manufacturing (+9.1%) and construction (+7.2%).

* RBI expects real GDP growth of 7.0% (+60 bps) in Q3FY26E and 6.5% (+30bps) in Q4FY26E. For the full year FY26E, growth is expected at 7.3% (+50bps). Growth remains constrained on account of impacted merchandise exports. However, heathy agricultural output, higher manufacturing activity, improving consumption demand, robust balance sheets and sequentially higher credit growth bodes well for GDP growth.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

More News

EcoScope : GST Monitor: GST collections stood at INR2t in Jul?25 by Motilal Oswal Financial...