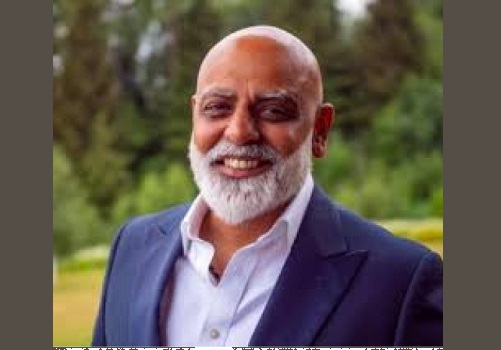

Quote On Gold and Crude by Kaynat Chainwala, AVP-Commodity Research, Kotak Securities

Below the Quote on Gold and Crude by Kaynat Chainwala, AVP-Commodity Research, Kotak Securities

COMEX gold retreated from its peak, closing at $2,668 per ounce on Friday, as softer inflation numbers bolstered expectations of rate cuts, but also sparking debate about their magnitude. Fed's preferred inflation measure, the Personal Consumption Expenditures (PCE) index, rose by 0.1% month-on-month and 2.2% year-over-year in August. Last Thursday, gold had surged to a record high of $2,708.70 per ounce, driven by a significant drop in consumer confidence that heightened expectations for more aggressive rate cuts by the Fed. Geopolitical tensions, particularly the ongoing conflict between Israel and Hezbollah, further enhanced gold's appeal as a safe-haven asset. Today, COMEX gold edged higher, trading near $2,675 per ounce as markets anticipate the upcoming U.S. jobs report, following last week’s data indicating that inflation is moving closer to the Federal Reserve's 2% target. The CME FedWatch tool shows that the odds of a larger rate cut increased to 53.3% after the PCE data release. Additionally, markets are keenly awaiting remarks from Fed Chair Jerome Powell, who is set to discuss the U.S. economic outlook today at a National Association for Business Economics conference.

WTI crude oil experienced significant losses last week, dropping to $66.95 per barrel as expectations of increased supply from Saudi Arabia and Libya overshadowed an improving demand outlook from China and concerns over Hurricane Helene. Libya is poised to restore production following an agreement among rival political factions to appoint a new central bank governor, while Saudi Arabia reportedly plans to increase output alongside OPEC+ members in December. Today, WTI crude prices steadied above $68.50 per barrel after a sharp 5% decline last week, as market participants evaluate the deteriorating situation in the Middle East and await Iran's response to Israel's recent killing of a Hezbollah leader. Prices may also receive support from better-than-expected manufacturing PMI numbers from China and easing home-buying restrictions in its three largest cities: Shanghai, Guangzhou, and Shenzhen.

Above views are of the author and not of the website kindly read disclaimer

Top News

MCX Gold is likely to trade with sideways to negative bias during today`s trading session - ...

Tag News

Evening Track : Commodities trading mixed as President Trump plans tariffs on Canada, Mexico...