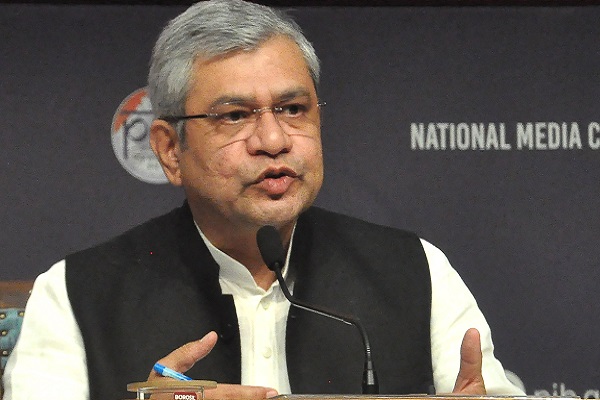

Quote on Daily Market Commentary for 22nd December 2025 By Siddhartha Khemka - Head of Research, Wealth Management, Motilal Oswal Financial Services Ltd

Below the Quote on Daily Market Commentary for 22nd December 2025 By Siddhartha Khemka - Head of Research, Wealth Management, Motilal Oswal Financial Services Ltd

Indian equities extended their rebound for the second straight session on Monday, supported by a firmer rupee and sustained FII buying over the past three days. The INR strengthened for the second consecutive day, aided by intervention from the Reserve Bank of India (RBI). Nifty50 closed higher by 206 points at 26,172 (+0.8%). The broader market also witnessed healthy participation, with the Nifty Midcap100 and Smallcap100 indices gaining 0.8% and 1.2%, respectively. Sectorally, market breadth remained positive with most Nifty sectoral indices ending in the green. IT and metals led the rally, rising 2.1% and 1.4%, respectively. Optimism around potential further rate cuts by the US Federal Reserve and a sharp rise in Infosys ADRs drove the Nifty IT index higher for the fourth consecutive session. Additionally, strong buying interest was seen in railway and defence stocks, driven by expectations from the upcoming Union Budget, particularly around capital expenditure and new project announcements. On the macro front, investors will track the UK Q3 GDP data due later today, followed by US Q3 GDP and Consumer Confidence data tomorrow. Overall, we expect markets to remain steady, supported by broad-based buying interest and favourable global cues.

Above views are of the author and not of the website kindly read disclaimer

More News

Market Quote : The global market is experiencing a heightened uncertainty due to US tariff i...