Public Capex Momentum Remains Strong in FY26, Core Growth Continues Despite Optical Inflation` by Emkay Global Financial Services

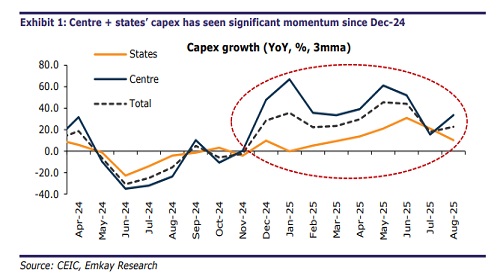

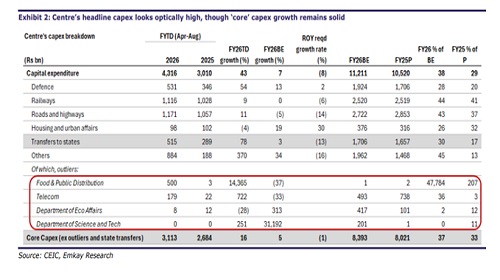

Emkay Global Financial Services in its latest report on Public Capex Economic update, cited that India’s public capital expenditure has maintained its strong momentum through the first five months of FY26, with both the Centre and States spending at a healthy pace. The Centre has already utilized nearly 39% of its budgeted capex, registering over 43% year-on-year growth, while States have increased their capital spending by around 14%. Despite the headline numbers appearing inflated due to base effects and sector-specific anomalies, Emkay Research notes that the “core capex,” after adjusting for one-off items, has also posted a robust 16% increase, indicating sustained investment activity across key sectors.

The report highlights that FY26 marks a shift towards frontloaded expenditure compared to FY25, when capex was backloaded due to the general elections. In 5MFY26, the Centre’s capital outlay has grown sharply, implying that even if the remaining months record an 8% contraction, the government would still achieve its budgeted growth of 6.6%. Similarly, States have followed suit, having spent 21% of their budgeted capex so far, which reflects a steady improvement in fiscal execution and infrastructure momentum across the country.

However, the report cautions that the impressive optics mask certain distortions. A significant portion of the Centre’s capex expansion has been driven by extraordinary items such as the telecom sector outlay—primarily comprising equity infusions into BSNL and funding for BharatNet—which surged over 722% year-on-year to Rs.179 billion. The Food and Public Distribution Department has also contributed disproportionately to overall growth, accounting for 37% of the Centre’s capex increase due to nearly Rs.500 billion being spent as advance to the Food Corporation of India, compared to a meagre Rs.3.3 billion last year. Moreover, loans extended to States have grown substantially and now constitute about 20% of the Centre’s capex, compared with less than 10% in FY22. When adjusted for these outliers, the underlying strength of the investment cycle remains visible, with core sectors such as Defence, Railways, and Roads and Highways recording significant gains. Defence spending has risen by 54% year-on-year, Railways by 9%, and Roads and Highways by 11%, while sectors such as housing and urban infrastructure continue to lag behind

Emkay Research also notes that States have performed commendably despite tighter fiscal conditions. Eighteen key States have achieved 21% of their budgeted capex so far this year, indicating a growth of around 14%. This is particularly noteworthy considering the revenue pressures many States face due to slower tax collections, delayed devolution from the Centre, and the persistence of high revenue expenditure linked to subsidies and populist schemes. Over the past two years, States have achieved between 88% and 89% of their budgeted capital outlays, a significant improvement over the ten-year average of 80%.

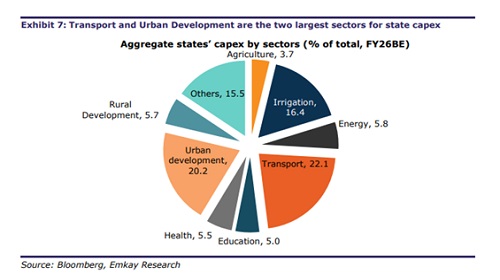

Transport and Urban Development continue to dominate the composition of States’ capital spending, accounting for 22% and 20% respectively, followed by Irrigation at 16% and Energy at 6%. These sectors are likely to remain the primary beneficiaries of both direct State allocations and Centre-supported programs in the current fiscal.

On the macro-fiscal front, Emkay Research projects that the general government’s capex-to-GDP ratio will hover between 4.9% and 5% in FY26. This would mark a slight decline from 5.1% in FY25 (provisional) and well below the FY24 peak of 5.4%. Nonetheless, the ratio remains significantly higher than pre-pandemic averages, indicating that India’s public investment-led growth model remains intact. The report adds that while fiscal deficit risks persist—especially due to slower revenue growth and GST rationalization—the Centre could offset potential shortfalls by trimming non-essential capex and reprioritizing spending. States, on the other hand, may see their fiscal deficits remain above 3% of GDP for the third consecutive year, underscoring the need for improved revenue mobilization and expenditure discipline.

Madhavi Arora, Lead Economist, Emkay Global Financial Services, said, “While the optics of public capex growth appear impressive, much of the expansion stems from one-offs such as equity infusions and advance allocations. Encouragingly, however, core sectors like defence and transport are showing genuine capex traction, which will be crucial for sustaining India’s investment-led growth narrative. If this momentum continues, public investment could remain a key pillar of India’s growth even amid revenue constraints.”

Despite certain distortions in the data, the underlying investment momentum in the economy remains healthy. The continued emphasis on capex by both the Centre and the States reflects a strong policy commitment to infrastructure development, with India’s general government capex-to-GDP ratio likely to remain close to 5% in FY26 — a level that reinforces the government’s long-term growth and fiscal prudence goals.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354