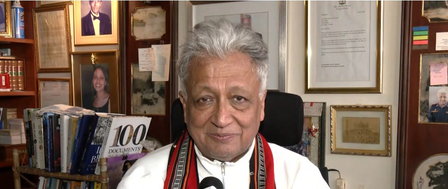

Post-market comment by Mandar Bhojane, Choice Broking

Below the Quote on Post-market comment by Mandar Bhojane, Research Analyst, Choice Broking

Closing Market Summary 21th Feb 2024

Indian equity indices halted their six-day winning streak and concluded lower on February 21, with the Nifty closing below the 22,100 mark. At the closing bell, the Sensex recorded a decline of 434.31 points or 0.59 percent, settling at 72,623.09, while the Nifty was down by 142.00 points or 0.64 percent, closing at 22,055.00.

The Nifty's daily chart revealed the formation of a bearish Engulf candlestick pattern, accompanied by substantial volume, signaling bearish sentiment from its all-time high level. If the price breaches the 22,000 level, there is potential for a further decline to around 21,800. Conversely, the immediate resistance for the Nifty is identified at 22,200.

The Relative Strength Index (RSI) displayed an upward slope at 57.5, indicating a sideways bullish momentum. Key support levels are recognized at 21,900-21,800, while obstacles are expected at 22,200 and 22,250.

On the sectoral front, apart from realty and PSU Bank, all other indices traded in the red. Both the BSE Midcap and Smallcap indices experienced a 1 percent decline.

The India VIX (Volatility Index) underwent an intraday negative movement of 0.90 percent, settling at 15.9275, suggesting an increase in market volatility.

Upon scrutinizing the Open Interest (OI) data, the call side revealed the highest OI at 22,200, followed by the 22,300 strike prices. On the put side, the maximum OI was observed at the 21,800 strike price.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Sensex surges 2,073 points, rupee posts best single-day gain since Dec 2018