PNC Infratech announces divestment of equity stake in 12 road assets for enterprise value of Rs 9,000 crore

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

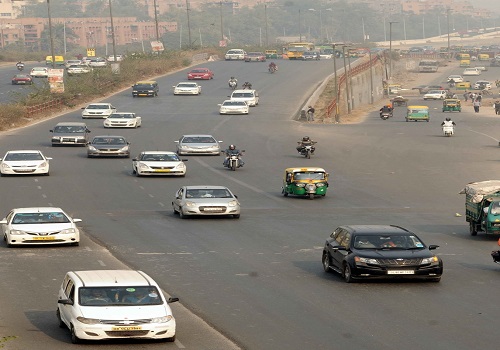

PNC Infratech Ltd and PNC Infra Holdings Ltd (PNC Infra), a wholly-owned subsidiary of PNC Infratech Ltd, have executed definitive agreements with Highways Infrastructure Trust (HIT), an Infrastructure Investment Trust (InvIT) whose sponsor is affiliated with funds, vehicles and accounts managed and advised by affiliates of KKR & Co Inc., to divest 12 of the company's road assets, which comprises of 11 National Highway (NH) Hybrid Annuity mode (HAM) assets and 1 State Highway BOT Toll asset with approximately 3,800 lane km in Uttar Pradesh, Madhya Pradesh, Karnataka, and Rajasthan.

The enterprise value of the transaction is Rs 9,005.7 crore together with the earn outs and is subject to any adjustments as stipulated in the definitive agreements translating to an equity value of Rs 2,902 crore (including cash) on invested equity of Rs 1,740 crore.

The divestment is aligned with the company’s strategic objective of recycling the capital invested in operating road assets to leverage the ambitious growth vision that has been outlined by the government for this sector.

PNC Infratech Ltd Managing Director Yogesh Jain said: "We feel proud to announce this landmark transaction – one of the largest in terms of value in the Indian roads sector. The transaction demonstrates the continued investor interest in the sector for high quality portfolios. This deal demonstrates our multi-pronged strategic objective of value creation commencing from winning the concession in a competitive bid process, relying on our strong execution capabilities to develop the best-in-class infrastructure within the envisaged timelines and recycling the operating assets to unlock the value for all our shareholders. This transaction would help us further strengthen our strong balance sheet and would give us a large headroom to continue pursuing our growth ambitions."

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">