PNB Housing Finance scales new milestone, widens its distribution footprint to 300 branches across India

NB Housing Finance, one of India’s leading housing finance companies, today announced the successful expansion of its distribution network to 300 branches across India. This strategic growth marks an important milestone in its journey towards providing accessible and varied housing finance solutions to customers. Spread across 150+ unique cities in the country, PNB Housing Finance will now be able to fulfill the home ownership dreams of millions of individuals and contribute towards nation-building.

PNB Housing Finance added 100 branches in the last 4 months of FY24 alone, taking the total number to 300. It offers tailored financial solutions through 90 branches dedicated to serving Prime home loan customers, and a robust network of 160 branches to meet the needs of its affordable housing segment Roshni. Further, the Company has also diversified into a new category ‘Emerging Markets’, to leverage opportunities in the high-yielding customer segment through 50 branches in select geographies.

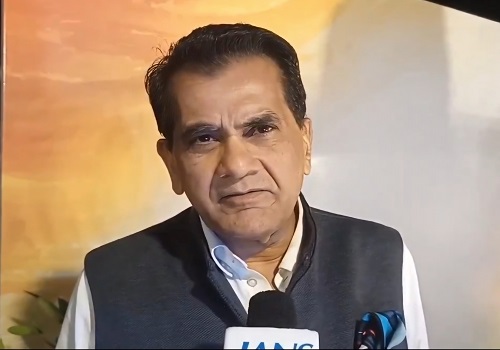

Mr. Girish Kousgi, MD & CEO, PNB Housing Finance, said, “As an organization that recognizes the cherished aspiration of individuals to own a home, we strategically chose to strengthen our omni-channel presence and expand our distribution footprint to provide tailored housing finance solutions to our customers. Further, our wide network of 300 branches will allow us to leverage market opportunities across diverse consumer segments and maximize profitability for the organization. We are excited to advance in this journey and leap into the next phase of growth.”

PNB Housing Finance offers a wide range of products like individual housing loans, retail loans against property, retail non-residential premises loans, and fixed deposits to both salaried and self-employed individuals. The Company’s branches are well-equipped with robust technology systems and internal capabilities, including efficient operations, processes and strong governance framework, to ensure a seamless customer experience.

Above views are of the author and not of the website kindly read disclaimer

Top News

Agricultural , allied sectors contribution to GDP can further rise on strengthened marketing...

Tag News

Muthoot Finance only Gold loan NBFC named in RBI`s Upper Layer List for three consecutive years