Perspective on Donald Trump`s reciprocal tariffs and impact on India by Ms Madhavi Arora, Chief Economist , Emkay Global Financial Services

Perspective on Donald Trump`s reciprocal tariffs and impact on India by Ms Madhavi Arora, Chief Economist , Emkay Global Financial Services

With Donald Trump announcing a review of existing tariff/trade arrangements between the US and the rest of the world, with a view to impose reciprocal tariffs, a few key insights pertaining to India's relative vulnerability and the possible impact are provided below:

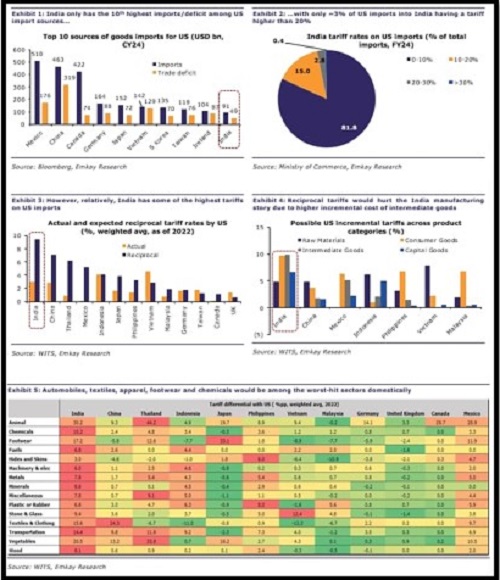

India ranked 10th among the top sources of US imports in CY24 (USD91bn), with Mexico (USD510bn), China (USD463bn) and Canada (USD422bn) as the top three countries. The US' trade deficit with India for CY24 was USD49bn - again substantially lower than the likes of China (USD319bn), Mexico (USD176bn) and Vietnam (USD129bn). This is significant, as the Trump administration is likely to target countries that have extremely heavy deficits with the US

A very low share of India's imports (by value) from the US have 'high' tariffs - ~82% of India's FY24 imports from the US had tariffs of 0-10%, while ~15% of imports had tariffs of 10-20%. Just ~3% of imports had tariffs higher than 20%

However, on a relative basis, India has among the highest tariffs on US imports - which means that it will be disproportionately hurt if reciprocal tariffs are imposed. This is true across most broad product categories - especially for intermediate goods, which could hurt the govt's current strategy of incentivizing domestic manufacturing/assembly

India will also be the worst-hit from reciprocal tariffs across nearly every large sector, with Chemicals, Transportation (automobiles), Textiles/Clothing and Footwear being among the worst-hit

Given that the Trump administration has only announced a review at present, with April being the earliest by when these tariffs could be implemented, it looks like a classic Trump move: announce and negotiate. PM Modi may be able to wangle some exceptions/favourable deals, but that would likely entail lowering import duties for some products, as well as higher Indian purchases of US goods, with Defence and Energy being prime sectors. We will wait for further developments in this space, while a detailed assessment of tariffs and the possible threats/opportunities for India will be published soon.

Above views are of the author and not of the website kindly read disclaimer