Opening Bell : Markets likely to get flat-to-positive start on Monday

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

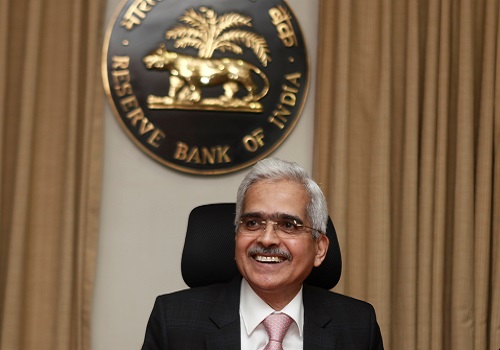

Indian markets ended volatile session flat with negative bias on Friday as profit-taking emerged in select sectors. Today, markets are likely to get flat-to-positive start tracking gains in Wall Street in Friday’s session. Foreign fund inflows likely to aid domestic sentiments. Foreign Portfolio Investors (FPIs) continued their bullish stance on Indian stocks, infusing Rs 16,881.03 crore in the second week of September, according to data from the National Securities Depository (NSDL). Some support will come with report that as India’s foreign exchange reserves have been rising for months now, hitting several all-time highs. The forex kitty increased by $66 billion so far this year and is currently at $689.235 billion. Besides, according to the payroll data, Employees’ State Insurance Corporation (ESIC) recorded a 13.32 per cent increase in subscribers addition to 22.53 lakh in July, 2024 compared to the figure of a year ago. Traders may take note of a report jointly released by Nasscom and consulting firm Zinnov stating that the total number of Global Capability Centres (GCCs) in India crossed the number of over 1,700, and the revenue of GCCs rose to $64.6 billion in the financial year 2024, and termed the country the GCC Capital of the world. However, there may be some cautiousness as Reserve Bank Governor Shaktikanta Das said inflation in India has moderated but still there is a distance to cover. The Governor further said while global economic activity and trade have largely withstood downside risks, the last mile of disinflation has proved to be challenging, giving rise to financial stability risks. Traders may be concerned as think tank Global Trade Research Initiative (GTRI) said India needs to increase container production, promote the use of domestic containers, strengthen domestic shipping firms and enhance port infrastructure as higher freight costs, container shortage and dependence on major shipping hubs and foreign carriers pose serious challenges to the country’s exports. There will be some buzz in coal stocks as the Ministry of Coal stated that the coal production in the country increased substantially during the fiscal year 2024-25. Edible oil industry stocks will be in focus as the government said India has raised the basic import tax on crude and refined edible oils by 20 percentage points, as the world’s biggest edible oil importer tries to help protect farmers reeling from lower oilseed prices. There will be some reaction in insurance industry stocks as the GST Council constituted a 13-member Group of Ministers (GoM) to suggest GST rate on premiums of various health and life insurance products and submit its report by October 30. Auto stocks will be in limelight as data released by the Society of Indian Automobile Manufacturers (SIAM) showed that total passenger vehicle sales in India declined 1.8 per cent in August to 352,921 units, as against 359,228 units same month last year. Meanwhile, investors will keep an eye out for the release of import and export data for August. Also, Bajaj Housing Finance, Tolins Tyres and Kross will list on the bourses today.

The US markets ended higher on Friday as market participants in the US eagerly await the Federal Reserve's policy decision this week slated on September 18. Asian markets are trading mostly in red on Monday in thin trade after economic data from China over the weekend disappointed as industrial output growth slowed to a five-month low in August, while retail sales and new home prices weakened further.

Back home, Indian equity benchmarks recouped most of their losses to end marginally lower on Friday on select profit-taking in Energy, FMCG and Oil & Gas shares. After making a cautious start, key gauges slipped into red and consolidated during the day as investors reacted to mixed industrial output and retail inflation readings. India's Consumer Price Index (CPI)-based retail inflation rose marginally in August to 3.65 per cent from 3.6 per cent in July, yet remained below the Reserve Bank of India (RBI)’s medium-term target of 4 per cent for the second time in nearly five years, mainly because of a high base during the same period a year ago. Separately, the Index of Industrial Production (IIP) also rose slightly to 4.83 per cent in July from 4.72 per cent in June. However, losses got trimmed as traders took support with G20 Sherpa Amitabh Kant’s statement that India will be driving 20 per cent of the world's economic growth in the next decade as it continues its march to become the third largest economy globally. He noted that India continues to be the fastest-growing large economy in the world and is the fifth-largest economy. Some support also came with Reserve Bank of India Governor Shaktikanta Das’ statement that India has a growth potential of at least 7.5 per cent. This projection is slightly above the Reserve Bank of India’s estimate of 7.2 per cent growth for the current financial year, FY25. Meanwhile, the Ministry of Finance has notified the new Foreign Exchange (Compounding Proceedings) Rules 2024 to simplify rules and regulations for foreign investments. The new rules are aimed at streamlining and rationalising existing rules and regulations to further facilitate ease of doing business. Finally, the BSE Sensex fell 71.77 points or 0.09% to 82,890.94, and the CNX Nifty was down by 32.40 points or 0.13% to 25,356.50.

Tag News

Indian markets to deliver positive returns for 9th year in a row, outperform US

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">