Nifty, with resistance levels consistently shifting lower & a breakdown insight - Tradebulls Securities Pvt Ltd

Nifty

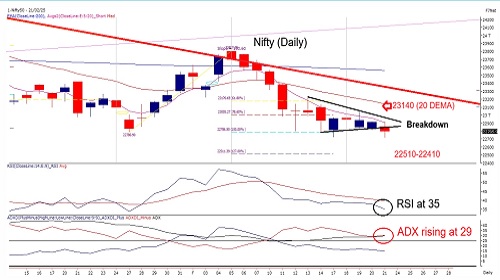

For Nifty, with resistance levels consistently shifting lower & a breakdown insight. The failure to reclaim the 5 DEMA suggests that selling pressure remains dominant, and the breakdown in RSI below 40 adds to the negative sentiment. Given the ADX strengthening, it indicates a strengthening trend, albeit on the downside. The shift in resistance from 23,540 to 23,210 highlights the market's inability to sustain higher levels, while support moving lower to 22,400-22,500 further confirms the weak undertone. The key trigger for any potential relief rally remains 23,040, but unless that level is taken out decisively, the trend favors a sell-on-rise approach. With option data reinforcing resistance at 23,000 and key support at 22,500, the probability of a downward breach remains high. Longs should be approached cautiously, preferably only if Nifty sustains above 23,210. Given the earnings season, a stock-specific strategy focusing on fundamentally strong but oversold counters might be a prudent approach in this volatile setup.

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838

More News

Market Watch : Hopes of trade deal with US keep traders interested by Geojit Financial Servi...

_Securities_(600x400).jpg)