Nifty Open Interest Put Call ratio rose to 1.45 levels from 0.95 levels - HDFC Securities Ltd

NIFTY : Uptrend Remains Intact; Momentum Is Positive

NIFTY METAL INDEX: Oscillators Are Positive and the Trend Remains Up

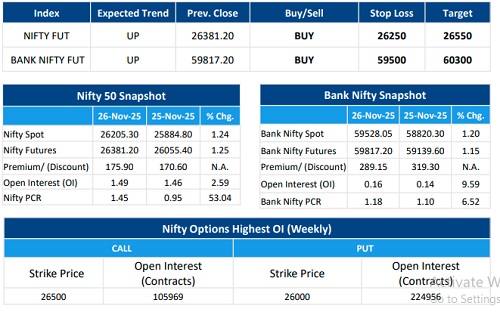

F&O Highlights

LONG BUILD UP WAS SEEN IN THE NIFTY & BANK NIFTY FUTURES

Create longs with the SL of 26250 levels.

* Nifty broke its three-session losing streak with a strong 320-point rally to close at 26,205, marking its second-highest close on record. The index reversed early weakness after opening 42 points lower and trended higher throughout the day to finish near the day’s high, signaling sustained intraday buying interest.

* Long Build-Up was seen in the Nifty Futures where Open Interest rose by 2.59% with Nifty rising by 1.24%.

* Long Build-Up was seen in the Bank Nifty Futures where Open Interest rose by 9.59% with Bank Nifty rising by 1.20%.

* Nifty Open Interest Put Call ratio rose to 1.45 levels from 0.95 levels.

* Amongst the Nifty options (02-Dec Expiry), Call writing is seen at 26500-26600 levels, indicating Nifty is likely to find strong resistance in the vicinity of 26500-26600 levels. On the lower side, an immediate support is placed in the vicinity of 26200-26300 levels where we have seen Put writing.

* Long build-up was seen by FII's in the Index Futures segment where they net bought worth 790 cr with their Open Interest going up by 2742 contracts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

More News

Stock Insights : Adani Enterprises Ltd, Ashoka Buildcon Ltd, Premier Energies Ltd, RailTel ...