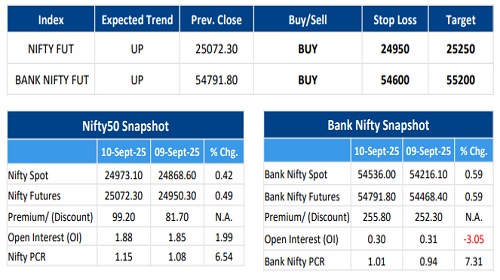

Nifty Open Interest Put Call ratio rose to 1.15 levels from 1.08 levels - HDFC Securities Ltd

F&O Highlights

LONG BUILD UP WAS SEEN IN THE NIFTY FUTURES

Create longs with the SL of 24950 levels.

* The Nifty continued its upward journey for the sixth consecutive session on the back of promising developments in bilateral trade discussions and strong overnight global cues. Nifty achieved its level above 25000, registered an intraday high at 25035, followed by a correction of 120 points towards 24915. However, post 2:45 P.M., Nifty registered a recovery of more than 70 points from the day’s low and ended the session on a strong note. The Nifty finally ended the day with a gain of 104 points, or 0.42%, to close at 24,973.

* Long Build-Up was seen in the Nifty Futures where Open Interest rose by 1.99% with Nifty rising by 0.42%.

* Short Covering was seen in the Bank Nifty Futures where Open Interest fell by 3.05% with Bank Nifty rising by 0.59%.

* Nifty Open Interest Put Call ratio rose to 1.15 levels from 1.08 levels.

* Amongst the Nifty options (16-Sep Expiry), Call writing is seen at 25200-25300 levels, indicating Nifty is likely to find strong resistance in the vicinity of 25200-25300 levels. On the lower side, an immediate support is placed in the vicinity of 24900-25000 levels where we have seen Put writing.

* Long build-up was seen by FII's in the Index Futures segment where they net bought worth 698 cr with their Open Interest going up by 4102 contracts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133