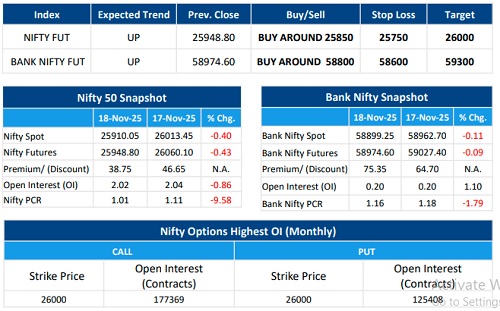

Nifty Open Interest Put Call ratio fell to 1.01 levels from 1.11 levels - HDFC Securities Ltd

Nifty : The market hit the roadblock @26000 mark. Further consolidation from here could be a buying opportunity.

Bank Nifty : Minor consolidation post breakout. Buying is likely to emerge from near the important support as per change in polarity.

F&O Highlights

LONG BUILD UP WAS SEEN BY FIIS IN THE BANK INDEX FUTURES

Create longs on dips with the SL of 25750 levels.

* Nifty snapped its six-session winning streak, slipping 103 points to close at 25,910 as broadbased selling dominated the session. On this weekly expiry day, volatility stayed elevated, with sellers gaining control in the latter half of trade.

* Long Unwinding was seen in the Nifty Futures where Open Interest fell by 0.86% with Nifty falling by 0.40%.

* Short Build-Up was seen in the Bank Nifty Futures where Open Interest rose by 1.10% with Bank Nifty falling by 0.11%.

* Nifty Open Interest Put Call ratio fell to 1.01 levels from 1.11 levels.

* Amongst the Nifty options (25-Nov Expiry), Call writing is seen at 26000-26100 levels, indicating Nifty is likely to find strong resistance in the vicinity of 26000-26100 levels. On the lower side, an immediate support is placed in the vicinity of 25700-25800 levels where we have seen Put writing.

* Long build-up was seen by FII's in the Index Futures segment where they net bought worth 117 cr with their Open Interest going up by 352 contracts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133