Nifty Open Interest Put Call ratio fell to 0.92 levels from 1.05 levels - HDFC Sescurities Ltd

Nifty : The market continued in a consolidation mode post decisive breakout. Expecting bounce from near the key lower support of 26100

Nifty Pharma : Decisive breakout of crucial trend line resistance. Selective Pharma stocks could be in limelight

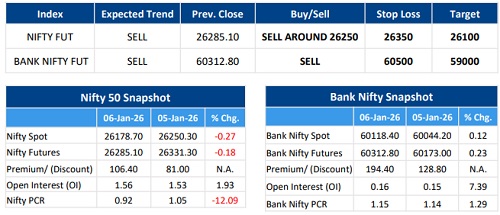

F&O Highlights

SHORT BUILD UP WAS SEEN IN THE NIFTY FUTURES

Create shorts with the SL of 26350 levels.

* Nifty extended its decline for the second consecutive session, losing 74 points to close at 26,175. After a weak start, the index quickly rebounded, gaining 129 points to hit an intraday high of 26,273 within the first hour of trade. However, the recovery proved shortlived as selling pressure resurfaced, dragging the index down by nearly 150 points from the day’s high to touch 26,124 around 2:30 p.m.

* Short Build-Up was seen in the Nifty Futures where Open Interest rose by 1.93% with Nifty falling by 0.27%.

* Long Build-Up was seen in the Bank Nifty Futures where Open Interest rose by 7.39% with Bank Nifty rising by 0.12%.

* Nifty Open Interest Put Call ratio fell to 0.92 levels from 1.05 levels.

* Amongst the Nifty options (13-Jan Expiry), Call writing is seen at 26300-26400 levels, indicating Nifty is likely to find strong resistance in the vicinity of 26300-26400 levels. On the lower side, an immediate support is placed in the vicinity of 26100-26200 levels where we have seen Put writing.

* Long build-up was seen by FII's in the Index Futures segment where they net bought worth 56 cr with their Open Interest going up by 5303 contracts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

More News

Indian equity benchmarks closed on a flat note amid mixed global cues - ICICI Direct