Nifty immediate support is at 26000 then 25900 zones while resistance at 26150 then 26277 zones - Motilal Oswal Wealth Management

Nifty Technical Outlook

NIFTY (CMP : 26068)

Nifty immediate support is at 26000 then 25900 zones while resistance at 26150 then 26277 zones. Now it has to hold above 26000 zones for an up move towards 26150 then 26277 zones while supports are placed at 26000 then 25900 zones.

Bank Nifty Technical Outlook

BANK NIFTY (CMP : 58867)

Bank Nifty support is at 58750 then 58500 zones while resistance at 59250 then 59500 zones. Now it has to hold above 59000 zones for an up move towards 59250 then 59500 zones while a hold below the same could see some weakness towards 58750 then 58500 levels.

Sensex Technical Outlook

Sensex (CMP : 85231) Sensex support is at 85000 then 84700 zones while resistance at 85500 then 85978 zones. Now it has to hold above 85000 zones for an up move towards 85500 then 85978 zones while supports are placed at 85000 then 84700 zones.

Midcap100 Index Technical Outlook

* Hovering around support levels and formed a bearish candle.

Smallcap250 Index Technical Outlook

* Breakdown below support zones and RSI weak.

USD/INR Spot Rate

Technical Stocks On Radar

Interglobe Aviation Ltd

(CMP: 5843, Mcap rs. 2,25,851 Cr.)

* Verge of falling supply trendline breakout above 5900.

* Formed a based around 50 DEMA

* RSI momentum indicator rising.

* Immediate support at 5670.

(CMP: 149, Mcap Rs. 24,016 Cr.)

Bandhan Bank Ltd

* Range breakdown on daily chart.

* Surge in selling volumes.

* RSI momentum indicator declining.

* Immediate resistance at 152.

Technical Chart Pattern for the Day

* “Rectangle” pattern breakdown

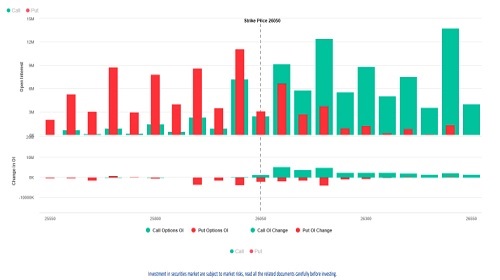

Nifty : Option Data

* Maximum Call OI is at 26200 then 26100 strike while Maximum Put OI is at 26000 then 26100 strike.

* Call writing is seen at 26100 then 26200 strike while Put writing is seen at 26100 then 25700 strike.

* Option data suggests a broader trading range in between 25600 to 26500 zones while an immediate range between 25900 to 26300 levels

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

MOSt Market Roundup : Nifty future closed positive with gains of 0.78% at 24759 levels by Mo...