Nifty immediate support is at 24550 then 24444 zones while resistance at 24850 then 25000 zones by Motilal Oswal Wealth Management

Nifty Technical Outlook

NIFTY (CMP : 24683)

Nifty immediate support is at 24550 then 24444 zones while resistance at 24850 then 25000 zones. Now till it holds below 24850 zones, profit booking could be seen towards 24550 then 24444 zones while hurdles can be seen at 24850 then 25000 zones.

Bank Nifty Technical Outlook

BANK NIFTY (CMP : 54877)

Bank Nifty support is at 54500 then 54250 zones while resistance at 55250 then 55555 zones. Now it has to cross and hold 55000 zones for a bounce towards 55250 then 55555 zones while a hold below the same could see a further decline towards 54500 then 54250 levels.

Stocks On Radar

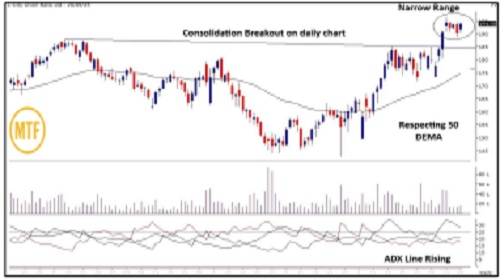

CUB

(CMP: 193, Mcap 14,337 Cr.)

* Consolidation breakout on daily scale.

* Formed a narrow range pattern suggesting more momentum above 196.

* ADX line suggesting strength.

* Immediate support at 188.

MUTHOOTFIN

(CMP: 2036, Mcap 81,525 Cr.)

* Range breakdown on daily scale.

* Bearish marubozu candle.

* Large selling volumes at lower levels.

* RSI indicator declining

* Immediate resistance at 2090

Derivative Outlook

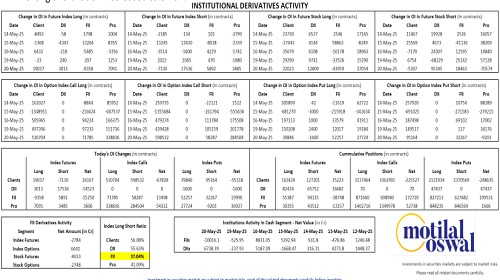

* Nifty May future closed at 24774.60 with a premium of 90.70 point v/s 30.95 point premium in the last session.

* Nifty Put/Call Ratio (OI) decreased from 0.82 to 0.69 level.

* India VIX increased by 0.17% to 17.38 level.

FII Cash & Derivative Activity

* FIIs on Derivatives front : Long unwinding along with short built up in index futures, call and put buying in index options

* In the cash market : FIIs were net sellers to the tune of 10016 Cr while DIIs were net buyers worth 6738 Cr.

* FIIs long short ratio : Decreased to 37.04%

Nifty : Option Data

* Maximum Call OI is at 25000 then 25100 strike while Maximum Put OI is at 24000 then 24500 strike.

* Call writing is seen at 25000 then 24800 strike while Put writing is seen at 24500 then 24300 strike.

* Option data suggests a broader trading range in between 24300 to 25200 zones while an immediate range between 24500 to 24900 levels.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

MOSt Market Roundup : Nifty future closed positive with gains of 1.28% at 26390 levels by Mo...