Nifty immediate support is at 22600 then 22500 zones while resistance at 22950 then 23150 zones - Motilal Oswal Wealth Management

Morning Market Outlook

* Market is expected to open on a weak note due to concerns over global market performance, the potential for the US to impose reciprocal tariffs on India, and continued FIIs selling.

* On Friday, the US markets saw declines of up to 2%, driven by weaker-than-expected economic data, raising concerns about inflation and growth.

* The Reserve Bank of India (RBI) has suggested that easing inflation might lead to rate cuts, with minutes from the February policy meeting indicating a possible reduction in rates at the upcoming April meeting. Blue Star, 360 ONE WAM Among 14 Stocks Added To FTSE All-World Index.

* Nifty Rejig: Jio Financial, Zomato will join NSE while BPCL and Britannia will exit from Nifty on March 28. Focus on Jio Financial, Lodha, FSL, PCBL.

* Crude oil prices hit two-month low to below $75/bbl amid rising supplies and demand concerns.

* The Gift Nifty is down by 0.5%.

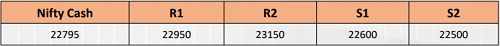

NIFTY (CMP : 22795) :

Nifty immediate support is at 22600 then 22500 zones while resistance at 22950 then 23150 zones. Now if it manages to cross and hold above 22850 zones then bounce could be seen towards 22950 then 23150 zones while supports can be seen at 22600 then 22500 zones.

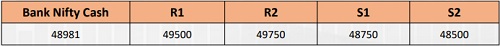

BANK NIFTY (CMP : 48981) :

Bank Nifty support is at 48750 then 48500 zones while resistance at 49500 then 49750 zones. Now if it manages to cross and hold above 49000 zones then bounce could be seen towards 49500 then 49750 levels while supports can be seen at 48750 then 48500 zones.

Derivative Outlook

• Nifty February future closed at 22,822.60 with a premium of 26.70 point v/s 29.35 point premium in the last session.

• Nifty Put/Call Ratio (OI) decreased from 0.90 to 0.82 level.

• India VIX decreased by 1.04% to 14.53 level.

• On option front, Maximum Call OI is at 24000 then 23500 strike while Maximum Put OI is at 22500 then 22300 strike. Call writing is seen at 23100 then 22800 strike while Put writing is seen at 22500 then 22700 strike. Option data suggests a broader trading range in between 22300 to 23300 zones while an immediate range between 22600 to 23100 levels

• Option Buying : Buy Nifty 22900 Call if it manages to cross and hold above 22850 zones. Buy Bank Nifty 49300 Call if it manages to cross and hold above 49000 zones.

• Option Strategy : Nifty Bull Call Spread (Buy 22850 CE and Sell 23050 CE) at net premium cost of 60- 70 points. Bank Nifty Bull Call Spread (Buy 49200 CE and Sell 49500 CE) at net premium cost of 90- 110 points.

• Option Writing : Sell Nifty 22150 PE and 23350 CE with strict double SL. Sell Bank Nifty 47800 PE and 50200 CE with strict double SL.

Fundamental Outlook

Global Market Summary:

• All the three US markets plunged sharply lower on Friday, as weaker-than-expected economic data raised concerns over inflation and growth. US February Service PMI fell to 17-month low to below 50 level, while existing U.S. home sales dropped more than expected to 4.08 million units

• Germany's Index Futures rose by 1% following the conservative opposition leader Friedrich Merz's victory in Sunday’s federal election, which aligned with opinion polls

• Dow Futures is up 180 points (+0.4%)

• Most Asian markets are mostly down 0.5-1%.

• Global Cues: Mixed

Indian Market Summary:

• Indian market ended lower on Friday, dragged by losses in heavyweight stocks and weak global cues.

• Benchmark index Nifty ended 117 points lower at 22,796 level (-0.5%)

• Broader market underperformed with Nifty Midcap down 1.3% and Nifty Smallcap down 0.7%.

• FIIs: -Rs3,449 crore DIIs: +Rs2,885 crore. Currently GIFT Nifty is indicating a weak start down 94 points (-0.4%).

• India’s Services PMI came at 11 month high

• Domestic Cues: Mixed

News and Impact :

• Mannapuram Finance: Bain Capital is finalising a deal with the promoters of Manappuram Finance to buy a controlling stake in the Kerala-based gold loan provider and non-bank lender, as per media reports. The Reserve Bank of India lifted restrictions on the latter’s subsidiary, Asirvad Micro Finance, a month ago. Impact: Positive

• Zydus Life: Company received final approval from USFDA for Ibuprofen and Famotidine Tablets, 800 mg/26.6 mg. Impact: Positive

Fundamental Actionable Idea

Federal Bank : CMP INR180, TP INR225, 25% Upside, Buy

• Federal Bank (FB) hosted its analyst meet, presenting a strategic vision under the leadership of MD & CEO Mr. KVS Manian to position itself among the top five private sector banks in India.

• With a legacy spanning over 93 years, a dominant presence in Kerala, and a refreshed focus on becoming a more comprehensive bank, FB is charting a path of sustainable growth, profitability, and technological advancement.

• The bank’s roadmap emphasizes scaling its operations prudently by prioritizing better-yielding loans, enhancing its liability franchise, and leveraging digital capabilities.

• The bank’s guidance of 1.5x nominal GDP growth and stable credit costs of 0.4-0.5% will contribute to the management’s vision of delivering superior RoA over the coming years

• We expect FB to deliver an earnings CAGR of 19% over FY25-27 with an RoA/RoE of 1.3%/14.6% by FY27. We reiterate our BUY rating with a TP of INR225 (premised on 1.4x Sep’26E ABV).

View: Buy

Interglobe Aviation : CMP Rs4492

• Domestic air passenger traffic in India maintained its upward momentum in January, reaching an estimated 150.3 lakh passengers, 0.7% increase MoM and a 14.5% jump YoY.

• Notably, January’s passenger traffic also surpassed pre-Covid levels from January 2020 by 17.9%.

• This could be partly due to increase in overall traffic in major airports in Uttar Pradesh due to Maha Kumbh

• Thus significant improvement in PLFs (capacity utilization) in 4QFY25 can be expected, a seasonally weak quarter. Higher demand could manifest itself in better yields in 4QFY25.

• Indigo with more than 60% market share stands to benefit

Quant Intraday Sell Ideas

What is this?

Based on technical indicators this strategy gives 2 stocks that have a high likelihood to fall during the day (from open to close). This is an intraday Sell strategy which can provide a good cushioning during a black swan event.

What are the rules?

• Stock names will be given at market open (9:15 am)

• Recommended time to entry: between 9:15 to 9:30 am.

• Entry: We short 2 stocks daily (intraday)

• Exit: we will exit at 3:15 as this is an intraday call

• SL: is placed at 1% of the open.

• Book profit: At 1% fall since open.

• In special situations the book profit might be delayed if the stock is in free fall.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Quote on Pre-market comment 31th October 2025 by Amruta Shinde, Technical & Derivative Analy...

.jpg)

.jpg)