Nifty has an immediate Resistance at 24800 and on a decisive close above expect a rise to 24870-24940 levels - Nirmal Bang Ltd

Market Review:

Indian benchmark ended with strong gains on Wednesday. The Nifty settled above the 24,700 mark, led by metal, pharma and PSU bank shares. The S&P BSE Sensex added 409.83 points or 0.51% to 80,567.71. The Nifty 50 index advanced 135.45 points or 0.55% to 24,715.05.

Nifty Technical Outlook

Nifty is expected to open on a gap up note and likely to witness positive move during the day. On technical grounds, Nifty has an immediate Resistance at 24800. If Nifty closes above that, further upside can be expected towards 24870-24940 mark. On the flip side 24640-24570 will act as strong support levels.

Action: Nifty has an immediate Resistance at 24800 and on a decisive close above expect a rise to 24870-24940 levels.

Bank Nifty

Bank Nifty’s next immediate resistance is around 54600 levels on the upside and on a decisive close above expect a rise to 54840-55000. There is an immediate support at 54130-53870 levels.

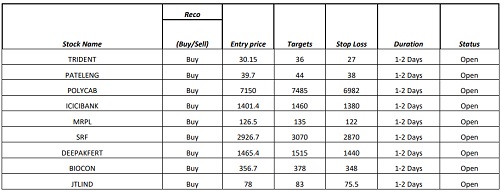

Technical Call Updates

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176

More News

Perspective on Markets 01st Sept 2025 by Mr. Vikram Kasat, Head - Advisory, PL Capital