Nifty gained 81 points or 0.3% to settle monthly expiry session at 24833 - ICICI Direct

Nifty :24833

Technical Outlook

Day that was…

Indian equity benchmarks regained upward momentum as sentiment got boosted by a U.S. trade court’s ruling blocking President Trump’s blanket tariff on imports. Nifty gained 81 points or 0.3% to settle monthly expiry session at 24833. Market breadth remained in favour of advances underpinned by firm broader market performance. Sectorally, barring FMCG, PSU Banks all other indices ended in green led by metal, realty, pharma

Technical Outlook:

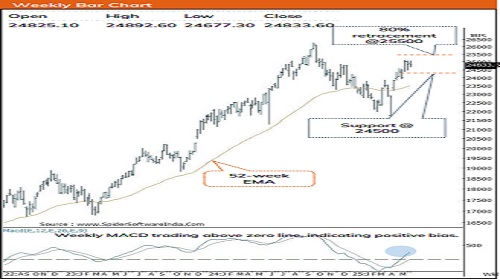

• The strong recovery in the second half helped Nifty to recover lost ground and conclude the session on a positive note. Nifty opened on a flat note and traded range bound activity throughout the session as Nifty oscillated by within ~130 points. As a result, daily price action formed a doji like candle, indicating prolongation of consolidation amid stock specific action. In the process, India VIX (which gauge the market sentiment) plunged 9%

• Going ahead, we expect prolongation of ongoing consolidation in the broader range of 25100-24500 aid positive bias wherein stock specific action would prevail. The past two weeks healthy consolidation while sustaining above 20 days moving average depicts inherent strength. In addition to that, formation of higher peak and trough backed by improving market breadth makes us believe, index would eventually resolve above upper band of consolidation and head towards 25500 in coming month. In the process, we expect volatility subside gradually as we approach the fag end of the earning season and now focus will shift towards upcoming RBI’s Policy (to be released on next Friday) Hence, any dip from hereon should be used as buying opportunity as strong support is placed at 24200-24400 zone.

• The current resilience in the broader market coupled with improving market breadth makes us believe that broader market will witness catch up activity and continue to outperform in the coming month, as currently, ~85% stocks of the Nifty 500 universe are trading above their 50 days EMA compared to last months reading of 65%. Further, past three months gradual up move has helped benchmark to regain some of its lost ground and now Nifty is just 5.5% away from its All Time High. In comparison to that, the small cap index is still 11% away from its All Time High. Following are the key monitorables from global perspective which would act as tailwind going ahead: a. The US Dollar index is on the verge of breakdown from two years low of 99.50 b. Weakness in Brent crude oil persists at higher levels , currently hovering around 64 c. Bilateral Trade Agreement between India and US

• The formation of higher peak and trough signifies structural uptrend that makes us revise support base at 24500 as it is 50% retracement of recent rally (23935-25116 rally (23935-25116).

Nifty Bank : 55546

Technical Outlook

Day that was :

The Bank Nifty opened o n a positive note and settled at 55746 , up 0 . 6 % . The Nifty Private Bank index remained outlier as it gained 0 .87 % to conclude the session at 27741 .

Technical Outlook :

• The bank nifty opened on a flat note and inched southward in the first half of the session and rebounded after taking support near Tuesdays low and made a strong recovery in last hour of trade . Consequently, settled a session on a positive note . The daily price action formed an strong bull candle with long lower shadow indicating buying demand at lower levels above 20 -day EMA .

• The Bank nifty index has been undergoing healthy retracement over past six weeks . The shallow retracement after 14 % rally seen during April signifies that the higher base has been set for the next leg of up move towards 57000 in the coming months, as it is the external retracement of the fall from 56 ,098 –53 ,483 . Meanwhile, strong support is placed at 54 ,000 , which is the 80 % retracement of the recent up -move (53 ,483 –55 ,499 ) and coincides with the gap area witnessed on 12th May (54 ,055 –54 ,442 ) . Hence, any decline from hereon would offer incremental buying opportunity

• Structurally, the Bank Nifty is witnessing elongation of rallies followed by shallow retracements, which signifies a robust price structure . The recent up -move of 14 % is larger compared to the previous month’s 9 % rise . Additionally, the declines are getting shallower, with the recent one being 4 . 6 % versus 5 . 4 % in March 2025 . Furthermore, the index broke out of an eight -month falling trendline and surpassed its lifetime high, highlighting a robust structure .

• The Private BANK index out performed the benchmark and closed on the upper band of the seven days range . Further, follow through strength above 27800 level will open the gate towards 28600 . Meanwhile, immediate support on the downside is placed at 27380 , being the placement of 20 -day EMA .

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

.jpg)

India VIX decreased by 0.13% to close at 11.21 touching an intraday high of 11.37 - Nirmal B...