Nifty 50 is poised for a cautious week and is likely to remain range-bound to mildly bearish, with 25400 emerging as the key pivot.

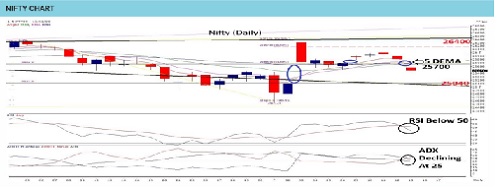

Nifty 50 is poised for a cautious week and is likely to remain range-bound to mildly bearish, with 25400 emerging as the key pivot. Multiple technical studies indicate immediate support in the 25400–25250 zone, followed by a stronger demand cluster near 25000, where key retracement levels and long-term averages converge. On the upside, immediate resistance is placed at 25700–25850, with a heavier supply zone near the 25900–26000 band, which is expected to cap gains during the week. Friday’s sharp sell-off has weakened the short-term structure, while derivatives data point to fresh short build-up, increasing downside risk if 25400 fails to hold. That said, a technical bounce on Monday cannot be ruled out after the sharp decline. A decisive break down below the 5 & 20 DMA convergence zone near 25460 could open the door for a move toward 25300.Consolidation between 25850 and 25240. A bullish bias emerges only on a sustained move above the upper band, while a clear corrective phase is likely on a confirmed break below 25400.

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838

More News

Market is expected to open on a flattish note and likely to witness range bound move during ...