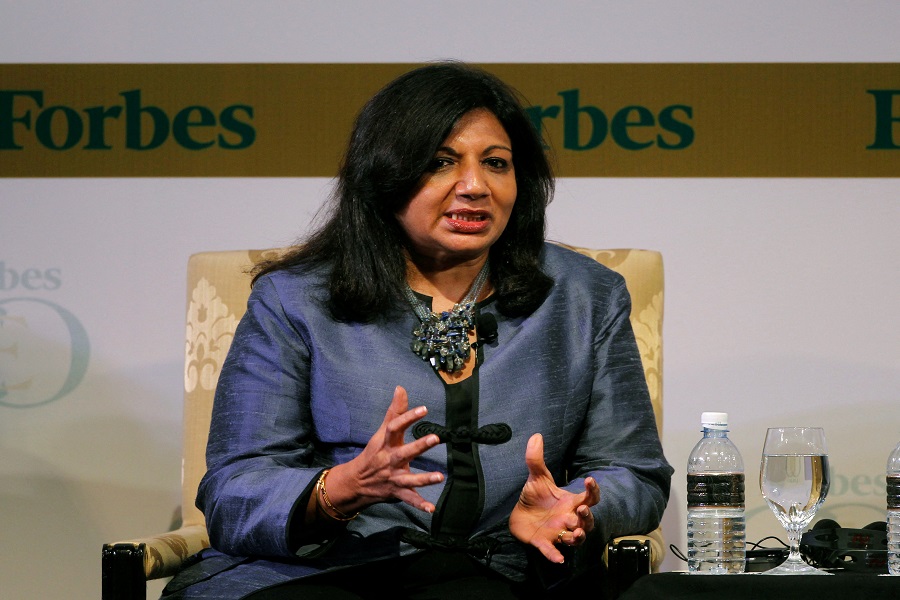

Neutral Biocon Ltd For Target Rs.300 By Motilal Oswal Financial Services Ltd

Generic/currency headwinds in biologics drag down earnings

* Currency headwinds in the biologics segment, pricing challenges, and a planned shutdown in the generics segment affected the overall performance of BIOS in 2QFY25.

* Despite these challenges, BIOS delivered improved profitability QoQ thanks to a strong revival in its Syngene business. It also continued to gain decent market share by volume in its key biosimilars in the US and EU. New launches, including liraglutide in the UK market, should boost the outlook of its generic segment in 2HFY25.

* We cut our earnings estimates by 56%/48%/25% for FY25/FY26/FY27, factoring in a) the delay in regulatory clearance for its sites, which could impact business prospects of key biosimilars like bAspart, b-Bevacizumab; b) reduced operating leverage; c) pricing pressure on the base portfolio of its generics segment; and d) high interest outgo. Our TP of INR300 is based on SOTP (16x EV/EBITDA for biologics business, 54% share in Syngene at a 15% holding discount, and 10x EV/sales for generics segment).

* Though BIOS has strong capabilities and capacities in the development and manufacturing of biosimilars, timely successful compliance remains vital for growth potential in this segment. We await clarity on USFDA compliance at its Malaysia and Bengaluru sites. BIOS is also building a product pipeline in the peptide category in the generic segment. Likewise, the Liraglutide ANDA file is under review with USFDA. Maintain Neutral.

Operating deleverage hurts profitability

* Total 2Q revenues grew 3.7% YoY to INR35.9b (est. INR36.3b). BBL (59% of sales) grew 11% YoY to INR2.2b. Syngene (24% of sales) declined 2% YoY to INR8.9b. Generics sales fell 8% YoY to INR6.2b (17% of sales).

* Gross margin (GM) declined by 20bp YoY to 64.4%.

* EBITDA margin was down 280bp YoY at 19.1% (est: 19.8%) due to higher employee costs (+550bp YoY as % of sales), offset by lower R&D/other expenses (-200bp/-130bp YoY).

* EBITDA margin for BBL was 21.5% (-150bs/-130bp QoQ). It was 28.5% for Syngene (+60bp YoY/+700bp QoQ basis). The generics business posted a negative EBITDA margin of 5.9% vs. positive margin of 5.1% YoY, but QoQ margin further declined by 240bp.

* EBITDA declined 7.4% YoY to INR6.8b (est: INR7b).

* After adjusting a one-off gain of INR260m for the reversal of provisions on inventory, adj. PAT declined 75% YoY to INR365m (est. INR256m).

* For 1HFY25, revenue grew 2% YoY to INR70b, EBITDA declined 10% YoY to INR13b, and adj. loss stood at INR1.2b (vs. profit of INR2.4b last year).

Highlights from the management commentary

* BIOS has indicated a better outlook for the rest of FY25, led by strong growth in Syngene in 2HFY25, market share gains in key biologics in the US, the launch of GLP-1 in the UK, and superior execution in other global markets.

* BIOS expects mid-teens growth over the next two years in the generics segment, led by the peptide opportunity, the launch of OSDs with near-term patent expiry, and cost optimization of its base portfolio.

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412