NeoGrowth lists first Foreign Currency bond (FCB) at India International Exchange (IFSC), Gift City

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

India International Exchange (IFSC) in GIFT City, witnessed NeoGrowth, the MSME-focused digital lender, listing the first Foreign Currency Bond (FCB) for Euro 3.5 million (approx. INR 32 Crore) from Developing World Markets (“DWM”). This also makes NeoGrowth, the first issuer to leverage the unified depository at GIFT City - India International depository IFSC Ltd. for issuance of the first ISIN for a FCB bond from GIFT IFSC.

DWM is a U.S. impact investing firm that has provided close to USD 20 million in debt financing to NeoGrowth since 2016 to support NeoGrowth’s digitally-enabled lending model aimed at closing the financing gap for Micro, Small, and Medium Enterprises in India.

NeoGrowth will allocate the funds for advancing its onward lending initiatives to support its MSME portfolio customers.

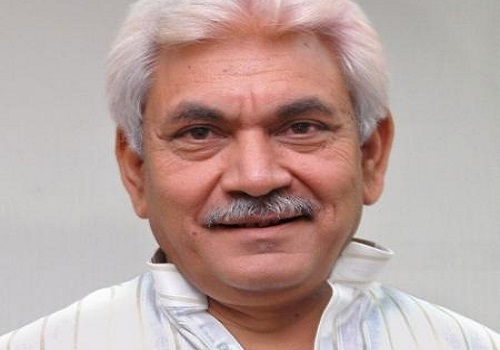

Commenting on the successful listing, Arun Nayyar, Managing Director & CEO, NeoGrowth, said: “The IFSC at GIFT City is a transformative prospect for Indian companies to secure offshore funds right here in India and we, at NeoGrowth, are proud to participate in this. As the initiative gathers traction it will not only help financial institutions like NeoGrowth to diversify our funding sources but also pave the way for other industries to seek funding beyond traditional channels.”

Robert Constantino, Head of Debt, DWM, said, “DWM is pleased to deepen its partnership with NeoGrowth through this additional financing that empowers MSMEs across India. Investing in NeoGrowth's values-driven lending initiatives is well-aligned with DWM's core strategy of providing impactful financing solutions that address social, environmental, and economic challenges in the developing world.”

NeoGrowth presently has an impressive INR 2,298 Crore in Assets Under Management (AUM). Since its inception, the company has successfully engaged with over 1,50,000 MSMEs, disbursing loans exceeding USD 1.1 Billion (over INR 10,000 Crore). As a leading SME lender in India, NeoGrowth has consistently achieved profitability over the past quarters, propelled by a comprehensive product suite, a robust data-driven underwriting model, profound customer engagement, and formidable data science capabilities throughout the value chain.

The company specializes in offering loans to small businesses, leveraging digital transactions and cash flow underwriting to assess business health. NeoGrowth's lending initiatives are dedicated to promoting financial inclusion for first-time entrepreneurs, women business owners, and underserved small businesses. Operating across 70+ segments, from neighborhood Kirana stores to emerging eateries and upscale salon operators, NeoGrowth delivers technology-driven, swift, and hassle-free loans to MSMEs in over 25 locations across India.

NeoGrowth's success is further fortified by the backing of esteemed investors such as Lightrock, Khosla Impact, Accion Frontier Inclusion Fund – Quona Capital, IIFL Seed Ventures Fund and Leapfrog Investments.

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">