Near-Term Pressures on Rupee from US Policies; FY26-End Outlook Steady by CareEdge Ratings

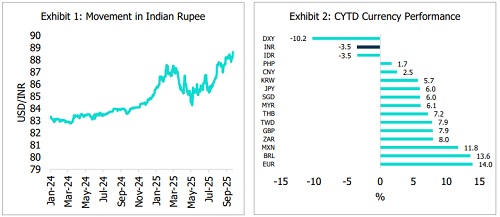

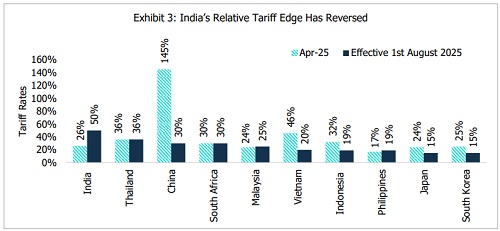

The Indian rupee has crossed the 88 level against the dollar and is trading near record lows. Unlike most major currencies that have appreciated year-to-date, the rupee has depreciated (Refer Exhibit 1 and 2), pressured by the implementation of US secondary tariffs, the recent announcement of hike in H-1B visa fees, and sustained foreign portfolio investor (FPI) outflows.

In the near term, we expect the rupee to remain under pressure. However, the Reserve Bank of India (RBI) is likely to step in to curb currency volatility. That said we maintain our FY26-end forecast of 85–87 for USD/INR, supported by a soft dollar, firm yuan, India’s manageable current account deficit, and the prospect of a US–India trade deal. In the sections below, we examine these factors in detail.

Rupee Under Strain from US Policies

With secondary US tariffs on India taking effect in August due to its trade links with Russia, India’s total tariff burden has risen to 50%, placing it among the most heavily tariffed nations (Refer Exhibit 3).

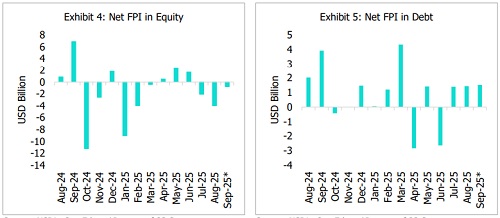

While India’s direct goods export exposure to the US is modest at about 2% of GDP, higher tariffs could erode competitiveness and amplify indirect growth impact. Discretionary sectors, such as gems and jewellery, are particularly vulnerable. At the same time, industries like footwear, textiles, and leather could lose market share to peers like Vietnam and Indonesia, which face lower tariffs. If 50% US tariffs persist, they could pull India’s FY26 GDP growth down to around 6%, compared with our base case of 6.5%, which assumes tariffs settle at 15%-20%. These concerns are weighing on FPI flows. Year-to-date net FPI outflows (equity and debt combined) stood at around USD 10 billion, driven by equity outflows (–USD 15.9 billion) and partly offset by debt inflows (+USD 5.9 billion) (Refer Exhibit 4 and 5). August saw the highest net FPI outflows in four months at USD 2.3 billion (equity and debt combined), while September (as of 23 September) has recorded marginal net inflows of USD 0.4 billion. However, the recent announcement of a sharp increase in H-1B visa fees may weigh on sentiment.

Media reports offer mixed signals. Some suggest a US–India trade deal could be reached by November, while others cite President Trump’s willingness to impose new tariffs on India and China, provided the EU joins in. Questions have also been raised about the legality of US tariffs. These uncertainties are likely to weigh on nearterm sentiment and continue to put pressure on the rupee.

We remain cautiously optimistic about a resolution in the coming months that could bring India’s tariffs closer to its peers, eventually easing rupee pressures. However, negotiations may be prolonged, given India’s caution on opening sensitive sectors such as agriculture and dairy. The risk of sectoral tariffs on pharmaceuticals and select electronics, which are currently exempt, also requires close monitoring.

Other Drivers Still Supportive of Rupee

A. Weak Dollar

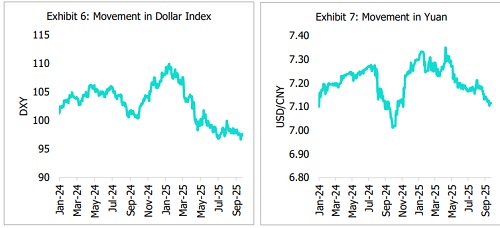

The dollar index has weakened by about 10% CYTD (Refer Exhibit 6), weighed down by US trade policy uncertainty, fiscal concerns, and expectations of Fed rate cuts.

Although trade tensions have eased since peaking in April 2025, US tariffs remain at their highest levels since the 1930s. These tariffs are expected to add to inflationary pressures in the US and weigh on domestic demand. The IMF World Economic Outlook (WEO, July) projects US growth to slow to 1.9% in 2025 from 2.8% in 2024. However, uncertainty remains as trade negotiations continue, questions around the legality of the tariffs persist, and exemptions for certain sectors could still be withdrawn.

Fiscal concerns are another headwind. The One Big Beautiful Bill could widen the deficit, adding to an already high federal deficit of USD 1.8 trillion in 2024 (6.4% of GDP). Structural concerns also persist, with central banks gradually diversifying away from US assets and increasing gold purchases, while questions over Fed independence further weigh on market sentiment.

The Fed cut its policy rate by 25 bps in September, and the median dot plot now signals two more cuts this year, up from one previously. Weak labour market data has reinforced market expectations of further easing. Payrolls were revised down by 911,000 for the 12 months through March, the steepest downward adjustment since at least 2000. Nonfarm payrolls rose by just 22k in August (vs 75k expected and 79k in July), while the unemployment rate climbed to 4.3%, the highest since October 2021. Overall, the outlook for the US dollar remains skewed to the downside, driven by the prospect of further policy easing amidst labour market concerns.

On the domestic front, we do not expect an RBI rate cut in the October MPC meeting. However, if high US tariff persists, FY26 GDP growth could slow to around 6%. This, coupled with potential downward pressure on inflation from GST rationalisation, may create room for further rate cuts later, likely another 25 bps. At a time when the Fed is expected to cut rates more aggressively than RBI, the interest rate differential could widen in favour of the rupee, providing some support.

B. Firm Yuan

During the first trade war in 2018–19, the yuan depreciated by 10–12% against USD. This in turn had put weakening pressure on the Indian rupee in that phase. This time, however, the yuan has appreciated 2.5% against the dollar CYTD (Refer Exhibit 7). The move has been supported by a weaker dollar and sharp reductions in US tariff rates from triple-digits, which have improved China’s growth outlook. The IMF, in its July WEO update, revised China’s 2025 GDP growth forecast up by 0.8 percentage points (ppt) from its April 2025 forecast to 4.8%, reflecting stronger-than-expected activity in H1 2025 and the significant tariff reduction. Growth in 2026 was also revised up by 0.2 ppt to 4.2%.

The weaker dollar, stronger daily fixings by the PBOC, and buoyant Chinese equity markets are likely to support the yuan in the near term. Key monitorables include the expiry of the trade truce with the US in November, the potential impact of transshipment-related tariffs, and rising duties from other countries, which could weigh on sentiment, especially amidst the backdrop of China’s persistent domestic challenges. That said, we expect the yuan to maintain an appreciation bias in the near term, with the USD/CNY marginally strengthening toward 7 by March 2026 from the current 7.11.

C. Manageable CAD and BoP Likely to Remain in Surplus

We expect India’s current account deficit (CAD) to stay manageable at 0.9% of GDP in FY26, supported by range-bound crude oil prices and resilient services exports. Our baseline assumes US tariffs at 15-20%. However, if the 50% tariff persists, CAD could widen slightly to 1.2–1.3% of GDP but would still remain manageable.

We expect Brent crude oil to average USD 68 per barrel in FY26, with weak global demand and rising OPEC+ output expected to keep prices contained. The narrowing Ural-Brent spread (around USD 4 per barrel vs an average of USD 20 per barrel in 2023) also limits the CAD impact from any loss of discounted Russian oil. Services exports are expected to moderate but remain healthy, growing 8.2% in FY26 (vs 13.6% in FY25). So far, these exports have not been directly affected by the trade war. However, recent developments, such as the increase in H-1B visa fees, could weigh on India’s services sector. At this stage, significant uncertainty remains, and these developments warrant close monitoring.

On the capital account, flows are likely to stay volatile. Net FDI moderated to USD 4.9 billion in Q1 FY26, down 21% YoY, reflecting higher outward FDI by Indian entities. Gross inflows increased 10.5% YoY to USD 25.2 billion, the highest since December 2020. However, repatriations/disinvestments edged higher by 1.8% YoY to USD 12.4 billion. Meanwhile, outward FDI by Indian companies surged nearly 80% YoY to USD 7.9 billion, weighing on the net FDI balance. Looking ahead, the prospects for global FDI remain weak in 2025, amidst escalating economic uncertainty, tariff tensions, and financial market volatility that weigh on investor sentiment. While we expect India’s gross FDI inflows to remain healthy, net FDI inflows could show a muted performance.

FPI flows have also been uneven, with year-to-date net FPI outflows (equity and debt combined) at around USD 10 billion, driven by equity outflows (–USD 15.9 billion) and partly offset by debt inflows (+USD 5.9 billion). Flows may remain volatile amidst ongoing uncertainties. However, possible inclusion of Indian bonds in the Bloomberg Global Aggregate Index could provide some support. Overall, India’s balance of payments (BoP) surplus is expected to moderate in FY26 but remain positive.

D. Favourable Domestic Factors

Low inflation, RBI rate cuts, and lower tax burden support India’s growth story, still positioning it as the fastest-growing major economy. In particular, the recent GST reform is a key development, marking an important milestone in India’s indirect tax journey. The reform introduces a simplified two-tier GST structure, comprising a 5% and an 18% rate, along with a special de-merit rate of 40% for select goods and services. These changes aim to boost consumption, further ease inflation, while also improving the tax buoyancy. We estimate GST reforms could lower CPI inflation by 70–90 bps annually. Fiscal impact is expected to be modest. We estimate GST rate changes to trim Centre and state revenues by ~0.2% of GDP each on an annual basis. FY26 fiscal impact is pegged at ~0.1% of GDP for both the Centre and states.

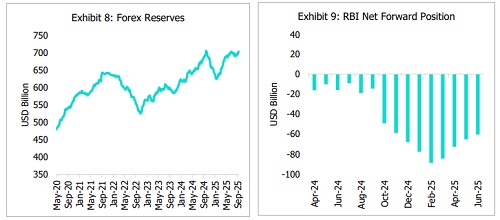

India’s forex reserves remain healthy at around USD 703 billion, near an all-time high, giving the RBI scope to intervene in the currency market and curb currency volatility if needed (Refer Exhibit 8). Meanwhile, the RBI’s net forward sales position has narrowed to around USD 60 billion as of June 2025 from a peak of ~USD 89 billion in February 2025 (Refer Exhibit 9), indicating further room for intervention if needed.

Looking Ahead

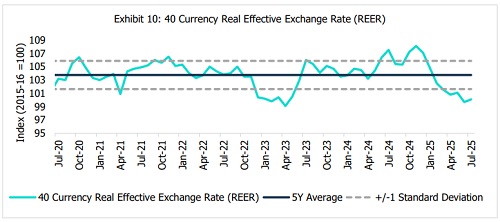

Near-term pressures may keep the rupee in the 88–89 range, driven by uncertainties around the US–India trade deal and the recent announcement of a hike in US H-1B visa fees, which is weighing on market sentiment. The visa fee increase could affect India’s services sector, which is particularly important as services have so far remained outside earlier tariff disruptions and play a key role in supporting India’s current account balance. However, at this stage, the situation remains fluid and warrants close monitoring. That said, we maintain our FY26-end forecast of 85–87 for USD/INR, supported by a soft dollar, a firm yuan, India’s manageable CAD, and the potential for a US– India trade deal. On a REER basis, the rupee is undervalued and below its five-year average (Refer Exhibit 10), suggesting some scope for appreciation in the medium term. Nevertheless, US–India trade negotiations, along with US visa policies, will be key to monitor for their impact on market sentiment and FPI flows.

Above views are of the author and not of the website kindly read disclaimer