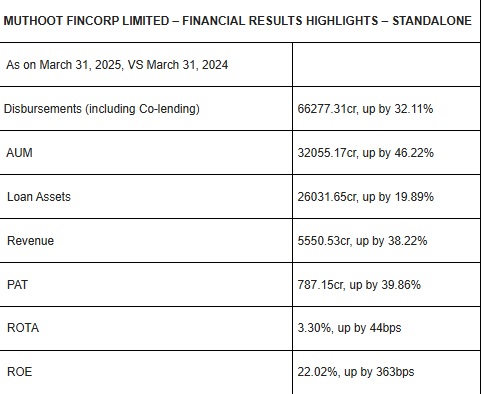

Muthoot FinCorp Reports 39.86% Net Profit Growth in FY25 with Y-O-Y Revenue Up by 38.22%

Muthoot FinCorp Limited, the flagship company of the 138-year-old Muthoot Pappachan Group, also known as Muthoot Blue, reported a net profit growth of 39.86% for FY25, reaching Rs 787.15 crore, up from Rs 562.81 crore in FY24. Year-on-year (Y-O-Y) revenue stood at Rs 5,550.53 crore, a 38.22% increase from Rs 4,015.77 crore. Disbursements for the year were Rs 66,277.31 crore, reflecting a 32.11% growth Y-O-Y.

Revenue for the quarter reached Rs 1,478.59 crore, marking a 23.49% increase from Rs 1,197.31 crore in Q4 FY24. Assets Under Management (AUM) stood at Rs 32,055.17 crore, up 46.22% from RS 21,922.70 crore in the same quarter of the previous year. The standalone net profit for the quarter was Rs 191.67 crore, compared to RS 239.79 crore in Q4 FY24, while disbursements rose to RS 19,648.29 crore from Rs 14,130.08 crore, a 39.05% increase.

Muthoot FinCorp Limited – Financial Highlights (Standalone)

Thomas John Muthoot, Chairman of Muthoot FinCorp Limited, said: “FY25 has been a deeply fulfilling year for us. The 39.86% growth in net profit and over 38% increase in revenue are not just financial achievements—they reflect the enduring trust of our customers, the strength of our purpose, and the dedication of our Muthootians across India. As our non-gold portfolio continues to expand and more households benefit from our inclusive offerings, we remain firmly committed to transforming lives by improving their financial wellbeing. Our journey forward is guided by this purpose and a deep responsibility to serve India’s aspiring millions.”

Mr. Shaji Varghese, CEO of Muthoot FinCorp added: “FY25 was a year of substantial progress, marked by the effective execution of our growth strategy. Our diversified product portfolio, comprising over three dozen offerings beyond our flagship gold loan, enabled us to serve a larger customer base, addressing their varied lifecycle needs. Notably, non-gold revenue now accounts for over 15% of our total revenue, underscoring the value proposition we bring to our customers. As we move forward, our focus remains on sustaining this momentum and cementing our position as a trusted financial partner for India’s lower-middle-income segment, ultimately contributing to our purpose of transforming lives through improved financial well-being.”

The Board of Directors has also approved the raising of up to Rs 8,000 crore through the issuance of Non-Convertible Debentures (NCDs), Subordinated Debt, Perpetual Debt, and Commercial Papers (CPs) during the current financial year, to support the Company’s growth and capital requirements.

Above views are of the author and not of the website kindly read disclaimer