14-09-2023 09:46 AM | Source: Geojit Financial Services Ltd

Morning Nifty and Derivative comments 14 September 2023 By Anand James, Geojit Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Views On Morning Nifty and Derivative comments 14 September 2023 by Anand James - Chief Market Strategist at Geojit Financial Services

Nifty outlook:

The 19944 region held for yet another day. Thus, despite the selling found towards close, the upside trajectory aiming 20230, or even 20600 continue to be in play. Downside marker may be pushed higher to 20033, with deeper support beyond 19944 seen at 19690. - Read more

Derivative:

Nifty weekly contract has highest open interest at 20100 for Calls and 19900 for Puts while monthly contracts have highest open interest at 20000 for Calls and 19000 for Puts. Highest new OI addition was seen at 20250 for Calls and 20000 for Puts in weekly and at 20100 for Calls and 20000 for Puts in monthly contracts. FIIs increased their future index long position holdings by 9.58%, decreased future index shorts by 5.62% and in index options by 26.60% in Call longs, 22.39% in Call short, 28.08% in Put longs and 14.41% in Put shorts. - Read more

USD-INR Outlook:

Upticks keep resurfacing on anticipated lines, being above 82.78, but refuse to push much above 83. To this end we will continue to employ a buy on dips approach. Slippage past 82.78 could call for 82.20, and signal an end to upside prospects though. We expect a break beyond 82.78-83 range soon. - Read more

Above views are of the author and not of the website kindly read disclaimer

Latest News

Asia Pacific investors bullish on Indian real estate...

Agri Commodity Technical Report 22 November 2024 - G...

Commodity Intraday Technical Outlook 22 November 202...

`One year of research?``, Ekta Kapoor promises for `...

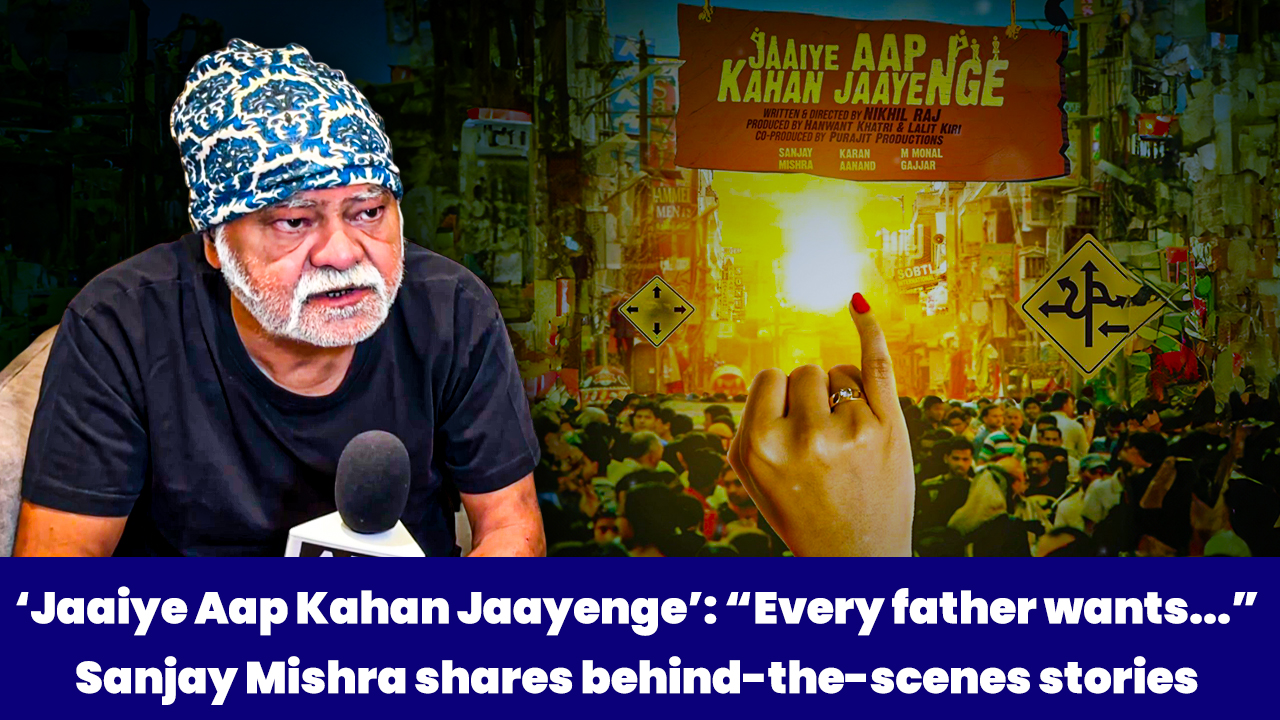

`Jaaiye Aap Kahan Jaayenge`:``Every father wants...`...

Turmeric trading range for the day is 14016-14660 - ...

Aamir Khan praises youth`s problem-solving spirit at...

Natural gas November is expected to hold above 270 a...

55th IFFI: Actor Nagarjuna recalls Bollywood`s `gold...

MCX Copper is likely to trade with sideways to posit...