Monthly Fixed Income Outlook September 2025 by ICICI Prudential Mutual Fund

Bond markets have seen notable volatility in recent months, despite a string of positive macroeconomic developments.

The RBI delivered a 50 bps policy rate cut in June 2025, followed by an announcement of 100 bps reduction in the Cash Reserve Ratio (CRR). Adding to the supportive backdrop, S&P upgraded India’s sovereign rating to BBB from BBB-, while headline inflation fell to an eight-year low of ~1.55%.

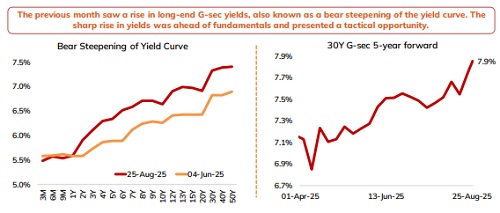

Contrarily, bond yields have risen by 30–50 bps across the curve, with long-duration G-Secs bearing the brunt i.e. a bear steepening in the G-sec yields curve. We attribute this move less to fundamentals and more to market sentiments, driven by evolving fiscal expectations and shifting regulatory dynamics. The resulting steepening of the G-Sec yield curve presents a compelling tactical entry point for investors.

The Month Gone By

Bear Steepening in G-sec Yield Curve

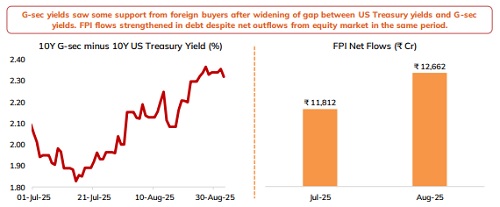

G-sec Spread over US Treasury Widens

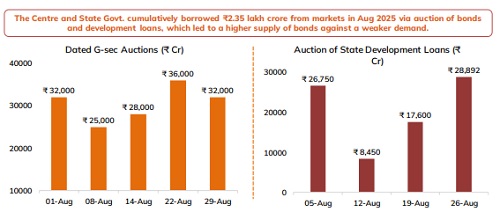

High Supply of G-sec, SDLs in Auction

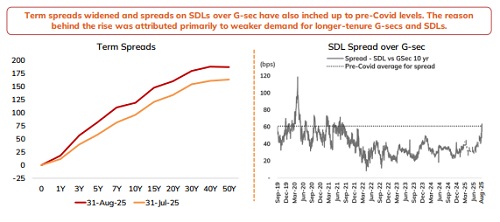

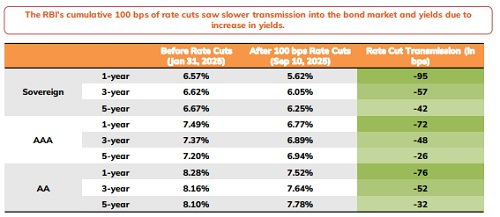

Term and Credit Spreads widened

Progress on Transmission

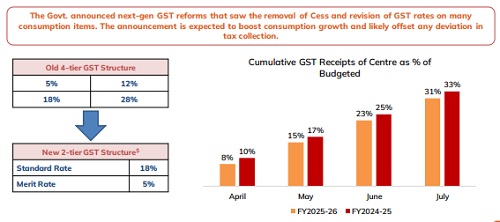

GST 2.0 Reforms

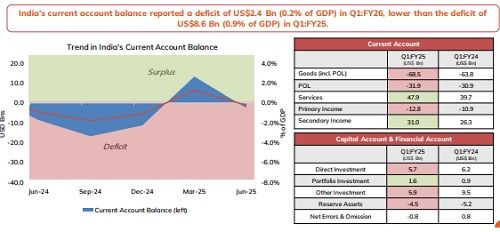

Current Account on the Fence

Above views are of the author and not of the website kindly read disclaimer

More News

Quote on Morning Market Views 15 July 2025 by Dr. VK Vijayakumar, Chief Investment Strategis...