Stocks in News & Key Economic Updates 18th December 2025 by GEPL Capital Ltd

Stocks in News

* KP GREEN: KP Group signed an MoU with the Government of Botswana to jointly develop large-scale renewable energy projects, including power generation, energy storage, and transmission infrastructure in the country.

* DENTA WATER AND INFRA: The company received four orders worth Rs.106 crore from Karnataka Urban Infrastructure Development & Finance Corporation for urban sanitation and water management projects across Karnataka.

* TITAGARH RAIL: The company received a Rs.273 crore order from the Ministry of Railways to manufacture rail-borne maintenance vehicles.

* OLA ELECTRIC: Ola Electric promoter Bhavish Aggarwal may sell additional shares in the open market to reduce his stake to 34 to 35% from 36.78% as of the September quarter, which would eliminate all promoter pledges, after selling 6.82 crore shares worth Rs.234 crore over the last two days.

* CYIENT: Cyient Semiconductors acquired a majority stake in Kinetic Technologies to strengthen its leadership in custom power ICs for Edge AI and highperformance computing markets.

* NTPC: The Delhi tax authority issued a Rs.16.9 crore demand order, including interest and penalty, over alleged disallowance of input tax credit, against which the company has filed an appeal.

* ASTRAZENECA PHARMA: CDSCO granted approval to import, sell, and distribute datopotamab deruxtecan powder in India, a drug used for the treatment of breast cancer in adults.

* AMC SOLAR: The arm commissioned an additional 8 MW capacity as part of its 100 MW wind power project in Gujarat.

* ANTONY WASTE: An arm JV received two orders worth Rs.1,330 crore from BMC for the collection and transportation of municipal solid waste.

Economic News

* India and Russia are creating a framework to boost bilateral trade to $100 billion by 2030: India and Russia are set to significantly increase trade. A new strategic economic plan targets $100 billion in bilateral trade by 2030. Trade has already seen substantial growth. The plan identifies key sectors and agencies for cooperation. Russia seeks to diversify trade beyond energy and defense. Moscow offers digital solutions for India's Smart City program.

* Terms of reference for Mexico trade pact likely next month: India's outbound shipments to Mexico totalled $5.75 billion in 2024-25 with light vehicles, motorcycles, base metals, auto parts, machinery, textiles and pharmaceuticals being the key exports. Imports, led by crude petroleum oil, smartphones and gold, amounted to $2.9 billion.

Global News

* BoE set for cautious rate cut as easing path remains gradual amid sticky inflation: The Bank of England is widely expected to cut rates by 25 bps to 3.75% this week as inflation eases and growth weakens, marking its fourth cut in 2025, but expectations of aggressive easing remain muted. While headline inflation has fallen sharply to 3.2% and the jobs market is softening, UK inflation remains the highest in the G7, with sticky services prices and lingering cost pressures limiting the scope for back-to-back cuts. Investors are pricing in only one more rate cut in 2026, as the BoE is likely to present any move as a cautious, gradual adjustment rather than the start of a full easing cycle, with policymakers remaining split and inflation risks still elevated.

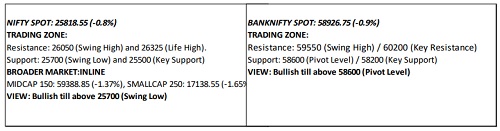

Technical Snapshot

Key Highlights:

Government Security Market:

* The Inter-bank call money rate traded in the range of 4.50%- 5.65% on Wednesday ended at 4.85%.

* The 10 year benchmark (6.48% GS 2035) closed at 6.5995% on Wednesday 6.5745% on Tuesday .

Global Debt Market:

US Treasury held modest gains after fluctuating in the wake of mixed US employment data that left the door open for further Federal Reserve interest-rate cuts in 2026. Yields were lower by less than three basis points in late trading, off session lows reached immediately after the November jobs report. It showed a bigger-thanestimated increase in the unemployment rate to 4.6%, the highest since late 2021 and exceeding the Fed’s forecasts for the next three years. The five-year tenor led the move, falling nearly three basis points to under 3.70%, below closing levels since Dec. 4. The yield declines were pared as the data also showed that hiring rebounded from losses in October led by private payroll gains, among other signs of strength. Investors also are mindful of US inflation data for November to be released Thursday, followed by the December employment report in early January. The market is furthermore preparing for trading books to close into year-end, a process that typically reduces risk appetite. “The market reacted to the higher-than-expected unemployment rate,” then to the offsetting increased labor-force participation figure, Jeffrey Rosenberg, senior portfolio manager at BlackRock told Bloomberg TV. November job creation at 64,000 “was pretty close to expectations, and don’t forget we will have another payroll number before the January meeting, that’s going to make these other two much less important,” he said.

10 Year Benchmark Technical View :

The 10 year Benchmark (6.48% GS 2035) yield likely to move in the range of 6.58% to 6.60% level on Thursday.

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer

More News

Quote on Pre-market comment for Friday February 6 by Hitesh Tailor, Research Analyst, Choice...