MCX Natural gas Dec is expected to dip towards Rs 410 level as long as it trades under Rs 434 level - ICICI Direct

Metal’s Outlook

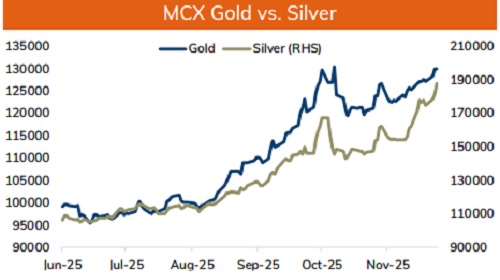

Bullion Outlook

* Spot Gold is likely to consolidate in the range of $4170 and $4250 ahead of today’s key Fed policy. Further, weaker set of economic numbers from US could force Fed to turn dovish. Additionally, concern over Fed independence resurfaced after White House National Economic Council Director Kevin Hassett emerged as the front-runner to serve as the next Fed chair. Meanwhile, investors will eye on key Fed projections and dot plot to get a better idea on frequency of rate cut in the coming year.

* MCX Gold Feb is expected to rise towards Rs131,000 level as long as it stays above Rs129,000 level. A move above Rs131,000, it would rise towards Rs132,000

* MCX Silver March is expected to rise towards Rs192,000 level as long as it stays above Rs185,000 level. A move above Rs192,000, would open the doors towards Rs194,500.

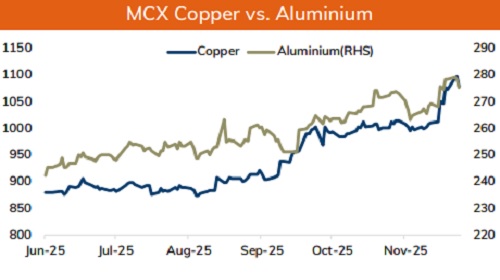

Base Metal Outlook

* Copper prices are expected to hold its ground and regain its strength on concerns over a supply shortage. Further, strong US demand and depleting inventory levels in LME would help the metal to regain its strength. Prices would get support on expectation of a proactive fiscal approach and loose monetary stance from China. Moreover, investors will also eye on key monetary policy outcome form the US Federal Reserve to get more clarity. Any sign of dovish stand would fuel the rally in the metals.

* MCX Copper Dec is expected to hold support near Rs1070 and move higher towards Rs 1095 level. Only break below Rs 1070 level it may fall towards Rs 1060-Rs 1055 level.

* MCX Aluminum Dec is expected to rise towards Rs280 level as long as it stays above Rs 275 level. Only a move below Rs 275, it would slip towards Rs 270. MCX Zinc Dec is likely to move higher towards Rs 315 level as long as it stays above Rs 308 level.

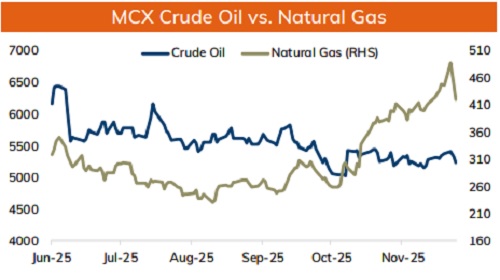

Energy Outlook

• Crude oil is expected to trade lower amid signs of weak demand in US. Weaker demand in crude oil products has raised the concern. The crack spread , the difference between gasoline and crude oil hit a 9- month low. Further, elevated supplies from OPEC+ and forecast of sizeable surplus over 2026 would restrict its upside. Meanwhile, further delay in the Russia-Ukraine peace deal, improved risk sentiments could limit its downside. Furthermore, investors will eye on key US Federal reserve’s policy to get more clarity in the interest rate outlook.

• MCX Crude oil Dec is likely to slip towards Rs 5200 as long as it trades under Rs 5400 level. Only a move above Rs 5400 it will turn bullish

• MCX Natural gas Dec is expected to dip towards Rs 410 level as long as it trades under Rs 434 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631