MCX Natural gas April is expected to face stiff resistance near Rs.365 level and slip further towards Rs.340 level - ICICI Direct

Bullion Outlook

* Gold is expected to correct further towards $3020 level amid strong dollar and recovery in US treasury yields. Dollar and Yields may move north on fears that US President Donald Trump policies on tax, tariffs and immigration may tilt US economy towards slower growth and higher inflation. Meanwhile, sharp fall in prices may be cushioned on safe haven buying following escalating geopolitical tension in Middle East as US kept up airstrikes on Yemen’s Houthi and Israel resumed bombing on Gaza ending 2-months ceasefire

* Spot gold is likely to correct back towards $3020 level as long as it stays below $3060 level. Only break below $3020 level prices may slip further towards $3000/$2980 levels. MCX Gold April is expected to dip towards Rs.88,300 level as long as it stays below ?89,200 level. A break below Rs.88,300 level prices may correct further towards 87,700 level

* MCX Silver May is expected to slip further towards Rs.98,000 level as long as it trades below Rs.100,500 level.

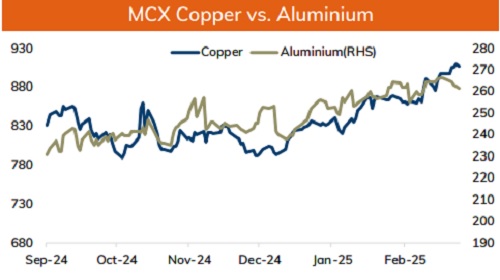

Base Metal Outlook

* Copper prices are expected to trade with negative bias on strong dollar and risk aversion in the global markets. Additionally, market fears that tit for tat approach increases the risk of global trade war, which may have adverse effect on economic growth denting demand for industrial metal. President Donald Trump still expected to implement new reciprocal tariff rates against major trading partners on April 2. Meanwhile, sharp fall in prices would be cushioned as China rolled out more stimulus measures to boost domestic consumption and PBOC is likely to cut interest rates at appropriate time.

* MCX Copper March is expected to slip towards Rs.900 level as long as it stays below Rs.915 level. A break below Rs.900 level prices may slide further towards Rs.895 levels

* MCX Aluminum March is expected to slip further towards Rs.257 level as long as it stays below Rs.263.0 level. MCX Zinc March is likely to move further south towards Rs.270 level as long as it stays below Rs.277 level

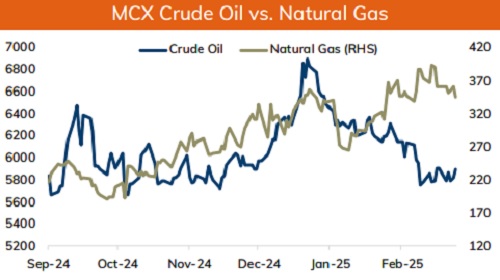

Energy Outlook

* NYMEX Crude oil is expected to trade with positive bias and rally further towards $70 level as risk premium may increase on escalating geopolitical tension in Middle East after Israel resumed ground operations and continued bombing Gaza, ending 2-months ceasefire. Moreover, prices may move up on supply concerns after US imposed new sanctions on Iran and new OPEC+ plan for 7 members to cut output to make up for producing more than agreed levels. Meanwhile, sharp upside may be capped as investors fear that potential global trade war will lead to slower economic growth, denting fuel demand

* MCX Crude oil April is likely to hold support near Rs.5780 level and rise towards Rs.6000 level. A break above Rs.6000 prices may rally further towards Rs.6050/Rs.6100 level.

* MCX Natural gas April is expected to face stiff resistance near Rs.365 level and slip further towards Rs.340 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Tag News

Silver Near $80 on Supply Tightness, Rate-Cut Bets by Amit Gupta, Kedia Advisory