MCX Crude oil April is likely to hold the support near Rs.5760 level and rise back towards Rs.5950 level - ICICI Direct

Bullion Outlook

* Gold is expected to correct back towards $2960 level on expectation of recovery in dollar and US treasury yields and profit taking. Dollar and yields may be supported as US has averted government shutdown after Senate passed bill to keep government funded for next 6 month. Additionally, investors fear that US trade war with its major trading partners will potentially impact the prices, forcing US Federal Reserve to be patient in cutting interest rates. Moreover, investors will remain vigilant ahead of economic data from US to gauge economic health of the country and get cues on future rate path

* Spot gold is likely to face stiff resistance near $3005 level and slip back towards $2960 level. A break below $2960 level prices may slide further towards $2940 level. MCX Gold April is expected to slip towards Rs.87,200 level as long as it stays below Rs.88,400 level.

* MCX Silver May is expected to correct towards Rs.99,000 level as long as it trades below Rs.102,000 level.

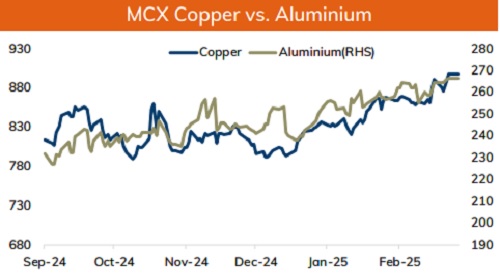

Base Metal Outlook

* Copper prices are expected to trade with negative bias on expectation of recovery in dollar and forecast of weak economic data from China. Moreover, credit aggregates from China contracted in February, limiting the outlook for the country's manufacturing. Moreover, investors fear over stagflation in US. Additionally, market fears that tit for tat approach increased the risk of broader global trade war, which may have adverse effect on economic growth denting demand for industrial metal. Meanwhile, top supplier Codelco warned that production this quarter will be similar or slightly below year ago levels due to maintenance work

* MCX Copper March is expected to slip back towards Rs.890 level as long as it stays below Rs.906 level. On Contrary, only break above Rs.906 level copper prices may rally further towards Rs.910 level

* MCX Aluminum March is expected to slip further towards Rs.262 level as long as it stays below Rs.266 level. MCX Zinc March is likely to move back towards Rs.277 level as long as it stays below Rs.282 level

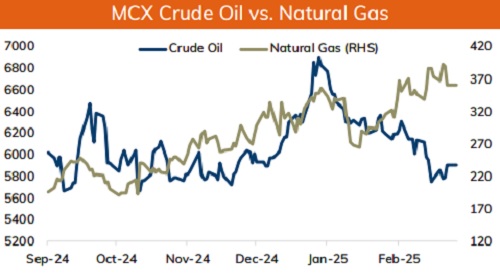

Energy Outlook

* NYMEX Crude oil is expected to trade with positive bias and rise further towards $69 level on escalating geopolitical tension after US vowed to attack Yemen Houthis until the group ends its assaults on shipping. Additionally, prices may rally on fears that peace talks between RussiaUkraine seemed stalled, which would delay more Russian energy supplies to Western markets. Meanwhile, sharp upside may be capped on concerns over global economic slowdown driven by escalating trade tensions between US and its trading partners. Moreover, IEA warned that global oil supply could exceed demand by around 600,000 bpd this year, due to growth led by the US and weaker than expected global demand

* MCX Crude oil April is likely to hold the support near Rs.5760 level and rise back towards Rs.5950 level. A break above Rs.5950 prices may rise further towards Rs.6050 level.

* MCX Natural gas March is expected rise back towards Rs.365 level as long as it stays above Rs.345 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631