MCX Copper is expected to move in the band of 702 and 712 - ICICI Direct

Metal’s Outlook:

Bullion Outlook:

• Spot gold is likely to face the hurdle near $2005 and weaken further towards $1980 on diminishing prospects of early cut to interest rates by the Fed. Meanwhile, expectation of weak retail sales numbers and sluggish growth in the manufacturing activity in US could provide some support to the bullions. Moreover, safe haven buying in the yellow metal amid geopolitical unrest in Mideast would restrict more downside in price

• MCX Gold April price is likely to move in the band of 61,000 and 61,700. Only close below 61,000 it would turn weaker and slide towards 60,600.

• MCX Silver is expected to face the hurdle near 71,200 and weaken further towards 69,200.

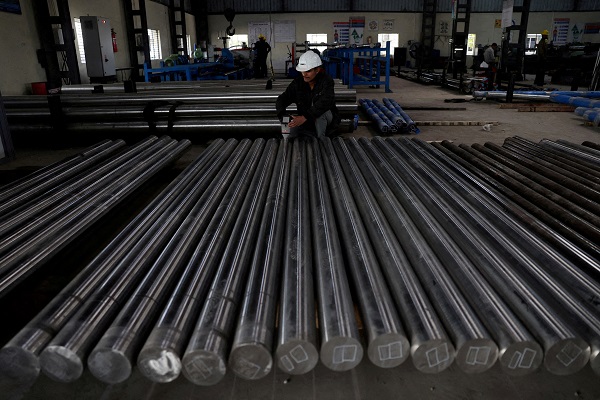

Base Metal Outlook:

• Copper prices are expected to consolidate as investors await fresh clues for trigger. Less than normal activity in China amid New year holiday would hurt base metal prices. Further, growing prospects of higher interest rate in major economies would hurt the demand outlook and limit any major upside in the red metal. Meanwhile, persistent decline in inventory level in LME and hopes of new measure from China would support the metal to recover some of it losses.

• MCX Copper is expected to move in the band of 702 and 712. Only a sustained move above 712 would push the price towards 716. On the flip side a move below 702 would weaken the price towards 695.

• Aluminum is expected to consolidate in the band of 199 to 202.50. Below 199 it would test next support at 198.

Energy Outlook:

• NYMEX Crude oil is expected to face the hurdle near $77 and weaken further towards $74 amid record high US crude oil production and inventory levels. Further, diminishing prospects of interest rate cuts by the Federal Reserve would also weigh on the prices. Meanwhile, persistence supply concerns due to unrest in the Mideast would limit its downside.

• MCX Crude oil March is likely to face the hurdle near 6460 and move lower towards 6250. Only a move above 6460 it would open the doors towards 6525.

• MCX Natural gas is expected to remain under pressure and slip further towards 130 level as long as it trades below 144 level. Higher production and mild winter weather forecast would check its upside.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631