MCX Copper Dec is expected to rise towards Rs1030 level as long as it stays above Rs 1012 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the positive bias and rise towards $4200 level on weak dollar and decline in US treasury yields across curve. Further, prices may rally as soft economic data followed by dovish comments from Fed officials bolstered expectation of another rate cut in December meeting. As per CME FedWatch tool traders are now pricing almost 85% chance of a rate cut in December, up from 30% a week ago. Moreover, prices may rally on strong central bank demand for gold and as the concern over Fed independence resurfaced after White House National Economic Council Director Kevin Hassett emerged as the front-runner to serve as the next Fed chair. Possibility of Hassett being nominated put rate cuts back on the table

* MCX Gold Dec is expected to rise towards Rs 126,800 level as long as it stays above Rs 124,500 level.

* MCX Silver Dec is expected to rise towards Rs 162,500-Rs 163,500 level as long as it stays above Rs 159,000 level

Base Metal Outlook

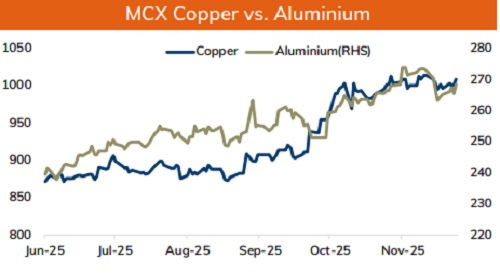

* Copper prices are expected to trade with a positive bias amid weak dollar, outflows to U.S. stocks and optimistic global market sentiments. Further, prices may rally on growing prospects of a December U.S rate cut following dovish signals from central bank officials and softer than expected economic data from U.S. Moreover, prices may move north on supply concerns. Chilean copper producer Codelco offered to supply some Chinese buyers at a premium of US$350 per ton over LME prices for 2026 annual contracts, reflecting tightness in copper market

* MCX Copper Dec is expected to rise towards Rs1030 level as long as it stays above Rs 1012 level. A break above Rs 1030 level may open doors for Rs 1035 level

* MCX Aluminum Dec is expected to rise towards Rs 274 level as long as it stays above Rs 270 level. MCX Zinc Nov is likely to hold the support near Rs 298 level and rise towards Rs 303.5 level

Energy Outlook

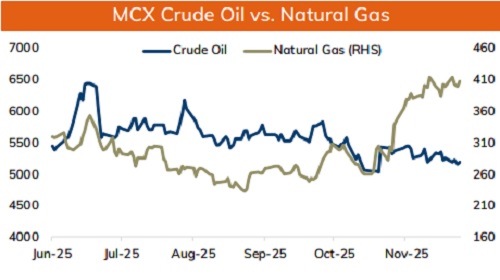

* Crude oil is likely to trade with negative bias and dip towards $57.30 level on rising crude oil inventories, prospects of oversupply and signs of positive progress in peace talk between Ukraine and Russia. Investors are of opinion that a peace deal may increase the chances of lifting sanctions on Russian crude exports adding more supply at a time of expectation of supply glut next year. As per EIA data U.S. crude inventories climbed by 2.8 million barrels to 426.9 million barrels last week. Inventories of fuel also rose, with gasoline and distillate up by 2.5 million barrels and 1.1 million barrels respectively. Meanwhile, sharp downside may be cushioned on weak dollar and rise in risk appetite in the global markets. Additionally, OPEC+ is likely to leave output levels unchanged at its meeting on Sunday

* MCX Crude oil Dec is likely to slip towards Rs 5100-Rs 5050 level as long as it stays below Rs 5300 level.

* MCX Natural gas Dec is expected to slip towards Rs 395 level as long as it stays below Rs 415 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631