Opening Bell : Markets likely to make cautious start amid mixed cues from other Asian markets

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

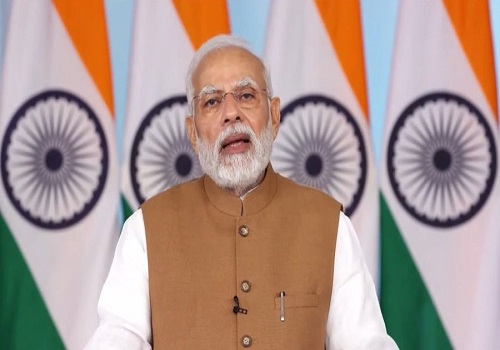

Indian equity markets ended deeply in red on Wednesday as data showed retail inflation breached the Reserve Bank’s upper tolerance level, soaring to a 14-month high of 6.21 per cent in October mainly on account of rising food prices. Today, markets are likely to make cautious start amid mixed cues from the other Asian markets. Traders may be cautious as Foreign Institutional Investors (FIIs) offloaded equities worth Rs 2,502.58 crore on Wednesday, according to exchange data. Meanwhile, India’s Chief Economic Advisor (CEA) V. Anantha Nageswaran emphasised that India needs to enhance its investment appeal regardless of political changes in the United States, focusing on internal economic reforms and scaling up enterprise growth. He highlighted key areas for India’s economic strategy, including deregulation, support for small and medium enterprises (SMEs), and a balanced approach to market volatility. However, traders may get some encouragement as S&P Global Ratings said supply capacity in India is continuing to expand pretty quickly which will help contain inflationary pressure. S&P Senior Economist Asia Pacific Vishrut Rana said the central bank’s monetary policy and inflation target remains credible and the Reserve Bank of India (RBI) should be able to anchor inflationary expectations. That remains a manageable challenge. Traders may take note of report that tax burden on individuals earning less than Rs 20 lakh a year, broadly described as middle class, has come down during the 10 years of Prime Minister Narendra Modi-led government, while there has been a substantial increase in taxes paid by those having annual income above Rs 50 lakh. As per the income tax return (ITR) filing data, the number of individuals showing annual income of over Rs 50 lakh has gone up to over 9.39 lakh in 2023-24, a five-fold jump from 1.85 lakh in 2013-14. Also, the income tax liability of those earning above Rs 50 lakh has gone up 3.2 times, from Rs 2.52 lakh crore in 2014, to Rs 9.62 lakh crore in 2024. There may be some buzz in mineral sector related stocks as the Ministry of Mines and International Energy Agency (IEA) signed an MoU for cooperation in the area of critical minerals. The collaboration would provide India with access to reliable data, analysis, and policy recommendations in the critical mineral sector.

Asian markets are trading mixed in early deals on Thursday after the U.S. October consumer price index reading fueled expectations for the Fed to cuts rates again in December. The US markets ended mostly in green on Wednesday after US CPI data for October came in line with expectation. The Labor Department said its consumer price index crept up by 0.2 percent in October, matching the upticks seen in each of the three previous months as well as expectations.

Back home, Indian equity benchmarks continued their losing streak and ended lower by over a percent each on Wednesday as traders remained tense in the wake of sustained selling by foreign investors. Foreign Institutional Investors (FIIs) offloaded equities worth Rs 3,024.31 crore on Tuesday, according to exchange data. Markets made a negative start and gradually drifted lower throughout the session as data showed retail inflation breached the Reserve Bank’s upper tolerance level, soaring to a 14-month high of 6.21 per cent in October mainly on account of rising food prices. Inflation based on the consumer price index (CPI) was 5.49 per cent in September and 4.87 per cent in the year-ago month. Besides, muted quarterly earnings, selling in frontline stocks like Tata Steel, Mahindra & Mahindra along with weak trends in the US and Asian peers hit markets' sentiment. Traders overlooked report that India Exim Bank said India’s merchandise exports are likely to grow 1.85% year-on-year to $107.5 billion in the third quarter of FY25 on the back of sustained momentum in economic activity and improving demand prospects in trading partners supported by expected global monetary easing. Traders also paid no heed towards the finance ministry’s statement that public sector banks (PSBs) have shown robust performance in the first half of the current fiscal year (H1FY25) with a 26 per cent growth in net profit, increase in business and decline in non-performing assets (NPAs). The aggregate business of 12 PSBs, including State Bank of India and Punjab National Bank, stood at Rs 236.04 lakh crore during the April-September period, registering an 11 per cent year-on-year (YoY) growth. Finally, the BSE Sensex fell 984.23 points or 1.25% to 77,690.95, and the CNX Nifty was down by 324.40 points or 1.36% to 23,559.05.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on?Market Wrap by Shrikant Chouhan, Head Equity Research, Kotak Securities

More News

Equity benchmarks concluded weekly expiry session on a subdued note following RBI Policy out...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">